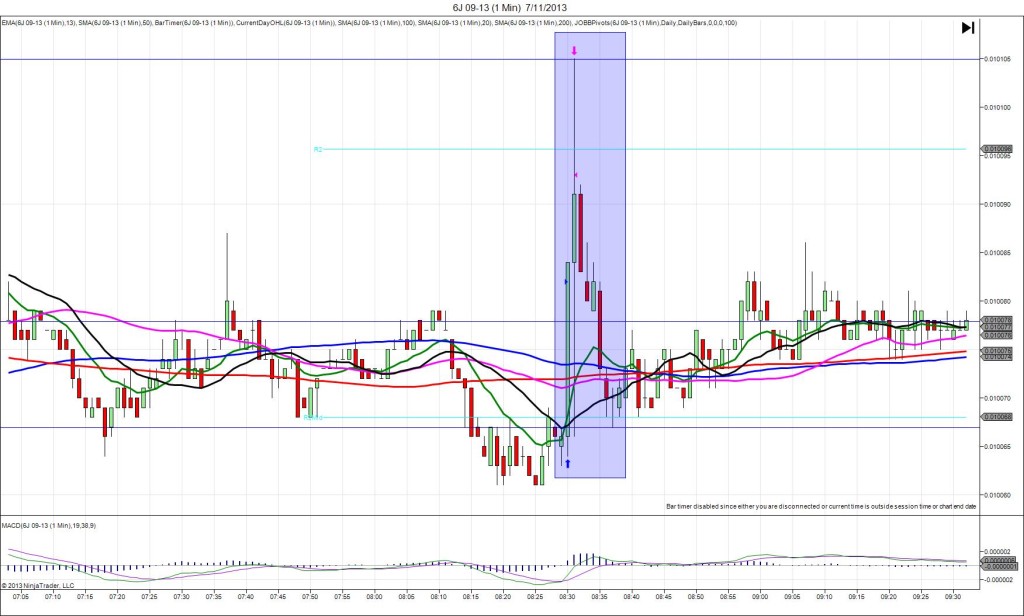

10/1/2013 Monthly ISM Manufacturing PMI (1000 EDT)

Forecast: 55.3

Actual: 56.2

Previous revision: n/a

SPIKE WITH 2ND PEAK

Started @ 133’08

1st Peak @ 133’01 – 1001 (1 min)

7 ticks

Reversal to 133’10 – 1016 (16 min)

9 ticks

2nd Peak @ 132’30 – 1039 (39 min)

10 ticks

Reversal to 133’06 – 1115 (75 min)

8 ticks

Notes: Report came in stronger than the forecast with 0.9 pts offset, and above 56.0. We saw a small drop of 6 ticks on 1 bar that crossed the 100 SMA and nearly reached the 200 SMA and S1 Pivot as the market was engaged in a small rally over the last 2 hrs. It was unsustainable and retreated back to the origin. More than likely the theatrics with the US government shutdown overshadowed this report to cause the muted reaction. With JOBB, you would have filled short at 133’05 with no slippage. If you did not set a profit target, look to exit at about 133’03 for 2 ticks as it hovered near the low until 16 sec into the bar before reversing. After the 1st peak, it flirted with the 100 SMA for a few min, then reversed to 133’10 on the :16 bar for 9 ticks. Then it geared up for a 2nd peak of 10 ticks, crossing the 200 SMA and S1 Pivot, before reversing for 8 ticks. Very tame market…