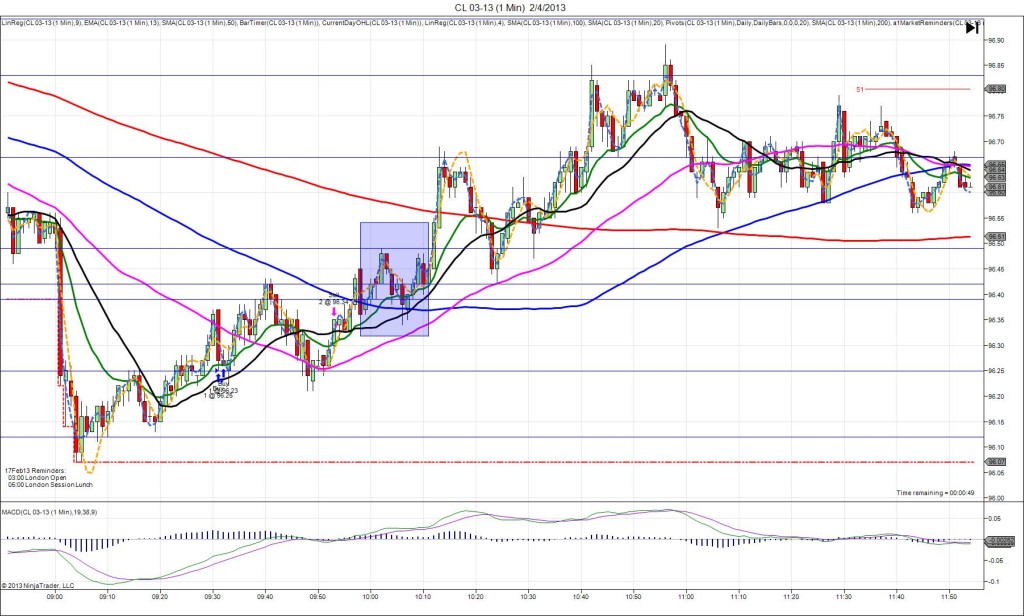

7/5/2013 Monthly Unemployment Report (0830 EDT)

Non Farm Jobs Forecast: 163K

Non Farm Jobs Actual: 195K

Previous Revision: +20K to 195K

Rate Forecast: 7.5%

Rate Actual: 7.6%

SPIKE WITH 2ND PEAK

Started @ 134’26

1st Peak @ 133’10 – 0831 (1 min)

48 ticks

Reversal to 133’29 – 0833 (3 min)

19 ticks

2nd Peak @ 132’20 – 0915 (45 min)

70 ticks

Reversal to 133’04 – 0939 (69 min)

16 ticks

Notes: Strong positive report showing 32K more jobs created than expected, a moderate previous upward revision of 20K jobs, and a 0.1% increase in the unemployment U-3 rate due to more people looking for work. This caused the bonds to selloff for 48 ticks on the :30 bar, eclipsing all 3 major SMAs near the origin and the S3 Pivot near the bottom, leaving 6 ticks on the tail naked. With JOBB, you would not have filled due to excess slippage with the thin trading on the 4th of July weekend as slippage exceeded 8 ticks. The 8 tick limit is a restriction from the CME, but we will have a workaround for the next report. After the 1st peak, it reversed for 19 ticks in the next 2 bars, before falling for a 2nd peak of 22 more ticks in 45 min, eclipsing the S4 Pivot. Then it reversed for 16 ticks in the next 24 min and traded between the S4 Mid Pivot and LOD for the rest of the session.