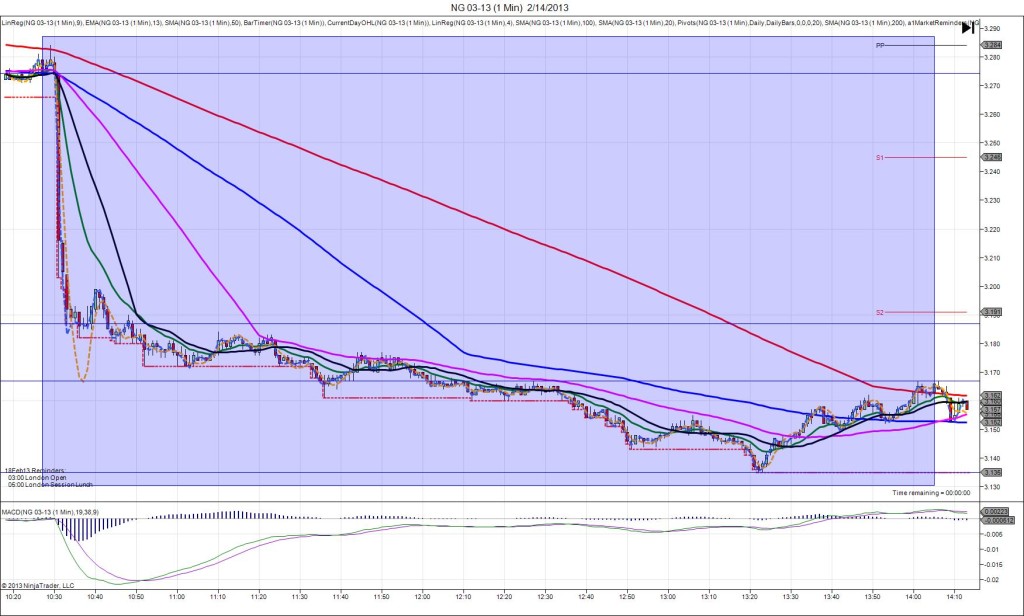

2/7/2013 Weekly Natural Gas Storage Report (1030 EST)

Forecast: -135B

Actual: -118B

SPIKE WITH 2ND PEAK

Started @ 3.414

1st Peak @ 3.341 – 1031 (1 min)

73 ticks

Reversal to 3.372 – 1032 (2 min)

31 ticks

2nd Peak @ 3.318 – 1136 (66 min)

96 ticks

Reversal to 3.345 – 1204 (94 min)

27 ticks

Notes: Smaller loss than was forecast caused a short spike of 73 ticks that was a few seconds premature, crossed no SMAs and the S1 / S2 Pivots. With JOBB, you would not have filled since the spike moved early on the :30 bar before the bracket was on the chart. After achieving the 1st peak, it reversed for a meager 31 ticks, then achieved a 2nd peak of 23 more ticks an hour later. The final reversal was slow developing, garnering 27 ticks in about 30 min to touch the 100 SMA.