4/5/2013 Monthly Unemployment Report (0830 EDT)

Non Farm Jobs Forecast: 198K

Non Farm Jobs Actual: 88K

Previous Revision: n/a

Rate Forecast: 7.7%

Rate Actual: 7.6%

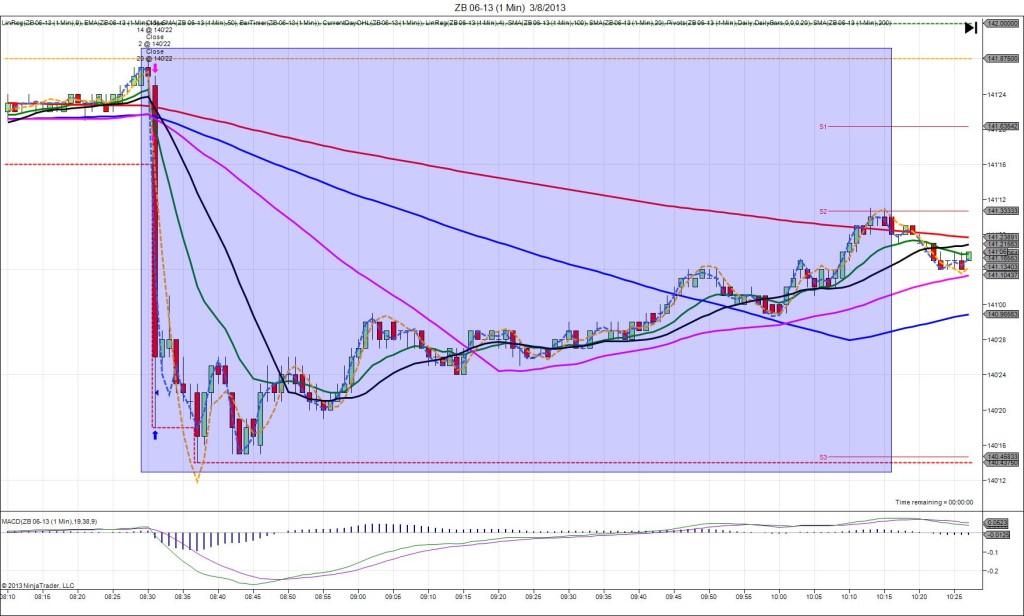

SPIKE WITH 2ND PEAK

Started @ 146’24

1st Peak @ 147’24 – 0831 (1 min)

32 ticks

Reversal to 147’16 – 0832 (2 min)

8 ticks

2nd Peak @ 148’00 – 0834 (4 min)

40 ticks

Reversal to 147’15 – 0847 (17 min)

17 ticks

Final Peak @ 148’02 – 0911 (41 min)

42 ticks

Reversal to 147’19 – 0923 (53 min)

15 ticks

Notes: Very negative report overall showing 110K less jobs created than expected, and a 0.1% improvement in the unemployment U-3 rate due to shrinkage of the labor force. This caused the bonds to rally for 32 ticks on the :31 bar, crossing the 50 SMA and the R2 Pivot near the origin, then peaking at the R3 Pivot. With JOBB, you would have filled long at about 146’30 with 2 ticks of slippage. Then you would have had an opportunity to capture about 20-24 ticks on the :31 bar, or up to 30 ticks on the :33 or :34 bars. Due to the R3 Pivot and the strong resistance normally accompanying, I elected to exit on the R3 Pivot for 24 ticks. Remember, all reports except 1 on the ZB have achieved 2nd peaks, so being patient and waiting for a target level if it did not initially fill is a safe move. After the peak, it reversed minimally for 8 ticks on the :32 bar, then rose again for a quick 2nd peak of 8 more ticks in 3 min. Then it reversed for 17 ticks in about 13 min to the area where the 13 and 20 intersected, before popping back up for a slightly higher final peak of 2 more ticks in 25 min. Then the final reversal eclipsed the 50 SMA and R3 Pivot for 15 ticks in 12 min. After that it continued to trade between the R3 Pivot and the HOD. Another amazing trade on the ZB!

-010413.jpg)

-010413.jpg)

-010413.jpg)

-120712.jpg)

-120712.jpg)

-120712.jpg)

-120712.jpg)

-110212.jpg)

-110212.jpg)

-100512.jpg)