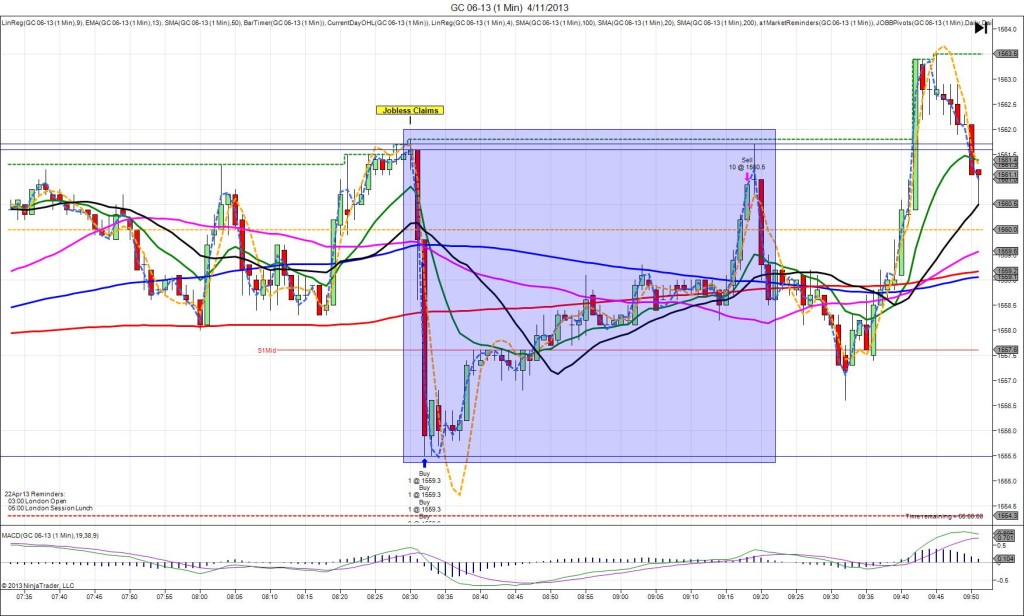

6/20/2013 Weekly Unemployment Claims (0830 EDT)

Forecast: 343K

Actual: 354K

SPIKE WITH 2ND PEAK

Started @ 0.010225

1st Peak @ 0.010247 – 0831 (1 min)

22 ticks

Reversal to 0.010234 – 0832 (2 min)

13 ticks

2nd peak @ 0.010256 – 0837 (7 min)

31 ticks

Reversal to 0.010224 – 0853 (23 min)

32 ticks

Notes: Report came in worse than the forecast by 11k jobs, causing a long spike of 22 ticks on 1 bar after the market had been trading sideways above the SMAs. It crossed the S2 Mid Pivot, peaked about 6 ticks higher, then pulled back for a 13 tick reversal on the :32 bar. With JOBB, you would have filled long on the :31 bar at about 0.010231 with 2 ticks of slippage, then wait for it to target the S2 Mid Pivot for 10+ ticks. After the reversal of 13 ticks, it rallied for a 2nd peak of 9 more ticks as it encountered resistance in the 0.010250 area. Then it reversed for 32 ticks in the following 16 min, reaching the 100 SMA.