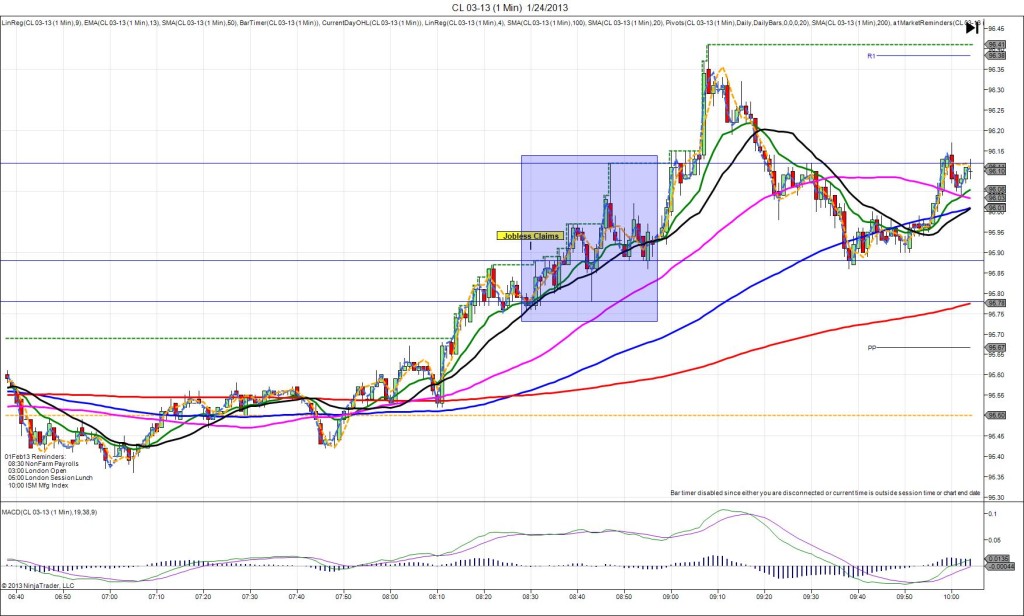

2/14/2013 Weekly Unemployment Claims (0830 EST)

Forecast: 361K

Actual: 341K

SPIKE WITH 2ND PEAK

Started @ 97.18

1st Peak @ 97.33 – 0834 (4 min)

15 ticks

Reversal to 97.04 – 0858 (28 min)

29 ticks

2nd Peak @ 97.54 – 0914 (44 min)

36 ticks

Reversal to 97.28 – 0933 (63 min)

26 ticks

Notes: Report came in strongly better than the forecast by 20K jobs, causing a 15 tick spike realized on the :34 bar. Since the market was already trending upward, this continued the momentum, but it had to contend with the PP Pivot. With JOBB, you would have filled long on the :31 bar at 97.24 with 1 tick of slippage on the PP Pivot, then seen it hover around 5 ticks of your fill point until it popped up on the :34 bar. Look for 5-8 ticks. After the peak, it reversed for 29 ticks just before the pit open, then achieved a 2nd peak of 36 ticks about 14 min after the open. The final reversal reclaimed 26 ticks in the next 20 min.

-112112.jpg)

-110112.jpg)

-101812.jpg)

-092012.jpg)

-090612.jpg)

-083012.jpg)

-082312.jpg)