11/26/2014 Monthly Durable Goods Orders (0830 EDT)

Core Forecast: 0.5%

Core Actual: -0.9%

Previous revision: +0.1% to -0.1%

Regular Forecast: -0.4%

Regular Actual: 0.4%

Previous Revision: +0.2% to -1.1%

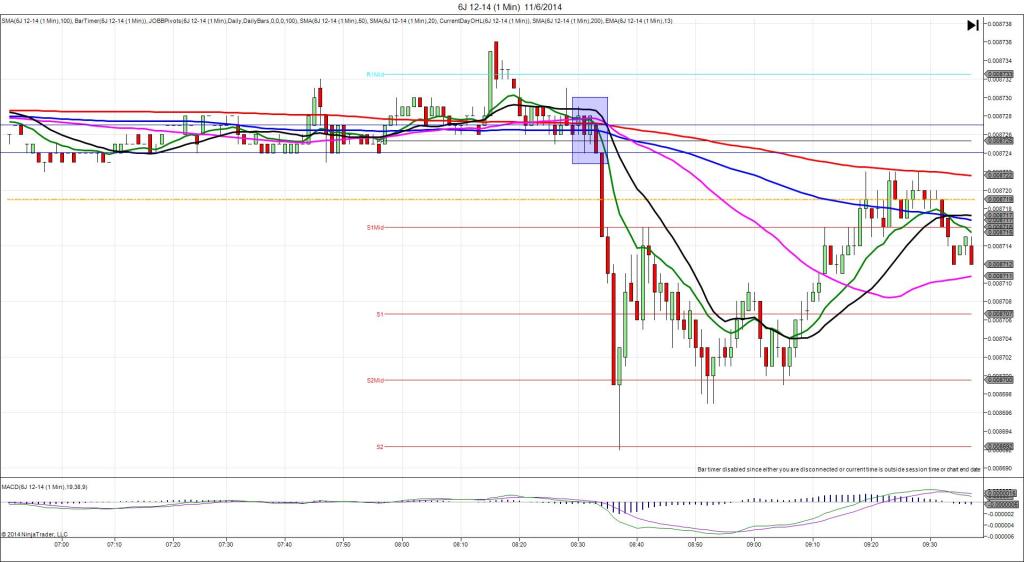

TRAP TRADE – INNER TIER (SPIKE WITH 2ND PEAK)

Anchor Point @ 0.008489 (last price)

————

Trap Trade:

)))1st Peak @ 0.008502 – 0830:01 (1 min)

)))13 ticks

)))Reversal to 0.008490 – 0830:06 (1 min)

)))-12 ticks

)))Pullback to 0.008500 – 0830:22 (1 min)

)))10 ticks

————

Reversal to 0.008494 – 0833 (3 min)

6 ticks

2nd Peak @ 0.008505 – 0841 (11 min)

16 ticks

Reversal to 0.008493 – 0854 (24 min)

12 ticks

Trap Trade Bracket setup:

Long entries – 0.008480 (on the LOD) / 0.008470 (on the PP Pivot)

Short entries – 0.008499 (match the high @0740) / 0.008509 (just above the R1 Pivot)

Notes: Mixed report caused an initial long spike followed by a quick reversal. The Core reading fell short of the forecast by 1.4% while the broader reading exceeded the forecast by 0.8% with small upward previous revisions. Unemployment claims also released with a 26K disappointment. It started on the R1 Mid Pivot and rose to cross the high from 0740 for 13 ticks with no other barrier near then fell 12 ticks 5 sec later. This would have filled your inner short entry immediately with 3 ticks to spare, then fallen to hover near the origin allowing 9 ticks to be captured. After that it pulled back 10 ticks in the next 16 sec then reversed 6 ticks on the :33 bar to the 50/100 SMAs. Then it climbed for a 2nd peak of 3 more ticks to reach the HOD in 8 min before reversing 12 ticks to the 200 SMA in 13 min.