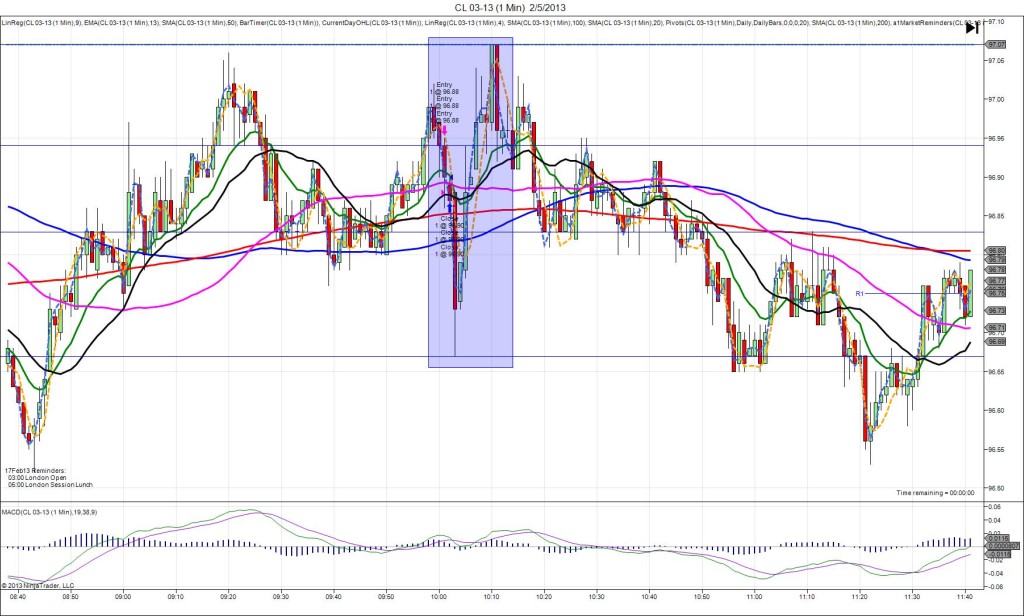

1/30/2013 Quarterly Advance GDP (0830 EST)

Forecast: 1.1%

Actual: -0.1%

Previous Revision: +1.1% to 3.1%

SPIKE/REVERSE

Started @ 97.83

1st Peak@ 97.46 – 0831 (1 min)

37 ticks

Reversal to 97.74 – 0836 (6 min)

28 ticks

Notes: Report strongly fell short of the forecast causing a short spike of 37 ticks on the :31 bar that crossed no SMAs or Pivots as it was already trending lower. It bottomed out at 97.46 on the 100 SMA on the 15 min chart. Normally an offset of over 1% on the GDP would provide a much larger reaction, but with a dismal forecast of only 1.1%, expectations were pessimistic to begin with. A healthy economy should have a minimum of 3-3.5% and a recovering economy should be 4-5% or more. With JOBB, you would have filled short at about 97.74 with 2 ticks of slippage, then had an opportunity to exit with about 20 ticks toward the end of the bar. If you look at the DX index for this time period, it did not move much, surprisingly. The reversal came quickly in the next 5 min for 28 ticks up to the 13 SMA. After that it fell for a double bottom, then chopped sideways in a 25 tick range.