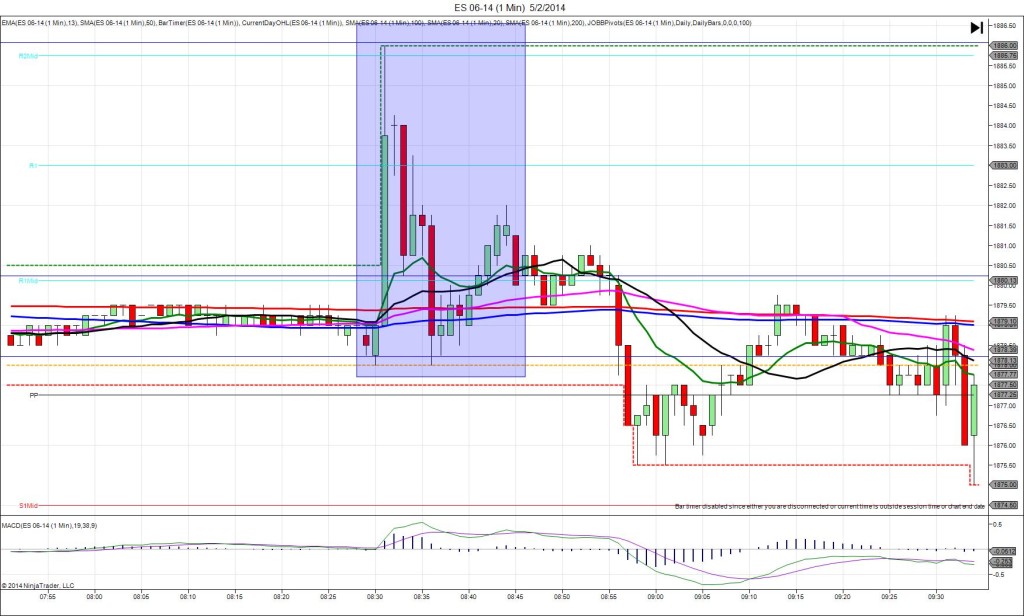

5/8/2014 Weekly Natural Gas Storage Report (1030 EDT)

Forecast: 71B

Actual: 74B

SPIKE WITH 2ND PEAK

Started @ 4.689

1st Peak @ 4.620 – 1030:00 (1 min)

69 ticks

Reversal to 4.649 – 1033 (3 min)

29 ticks

Final Peak @ 4.587 – 1108 (38 min)

102 ticks

Reversal to 4.607 – 1119 (49 min)

20 ticks

Notes: We saw a slightly larger gain on the reserve compared to the forecast which caused a healthy short spike. The spike started on the 50 SMA and fell to cross the S2 Pivot and extend the LOD for 69 ticks. With JOBB, you would have filled short at about 4.667 with about 12 ticks of slippage, then seen it fall and hover near the bottom for about 10 sec. A profit target of anything less than 45 ticks would have filled, otherwise look to exit with about 40 ticks where it hovered. After the hovering, it reversed to the S2 Pivot on the back end of the :31 bar and the next 2 bars, before stepping lower to a final peak of 33 more ticks in the next 35 min. Then it reversed for 20 ticks in the next 11 min and continued to trade sideways.