6/18/2014 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: -0.65M

Actual: -0.58M

Gasoline

Forecast: -0.11M

Actual: 0.79M

Distillates

Forecast: 0.25M

Actual: 0.44M

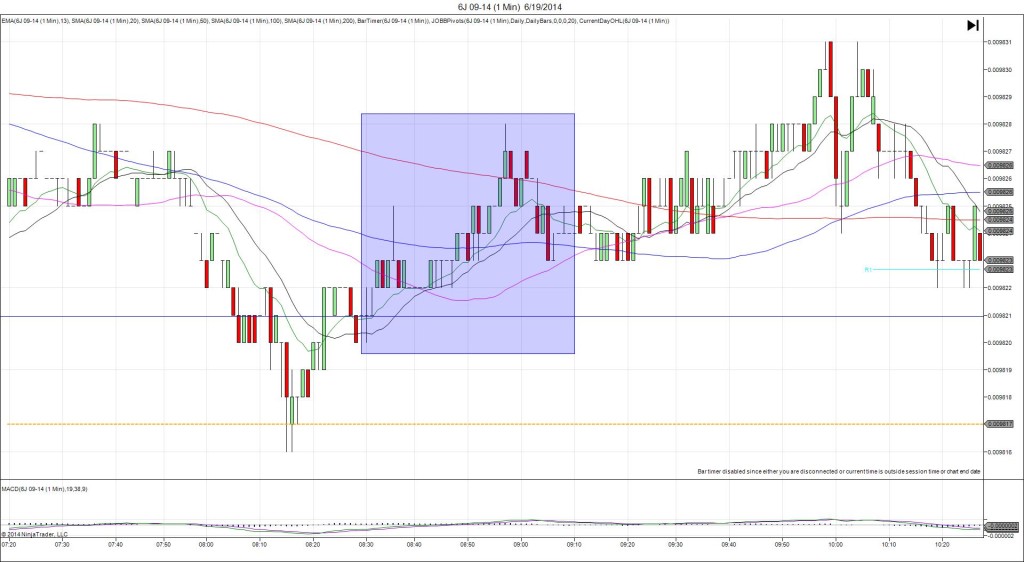

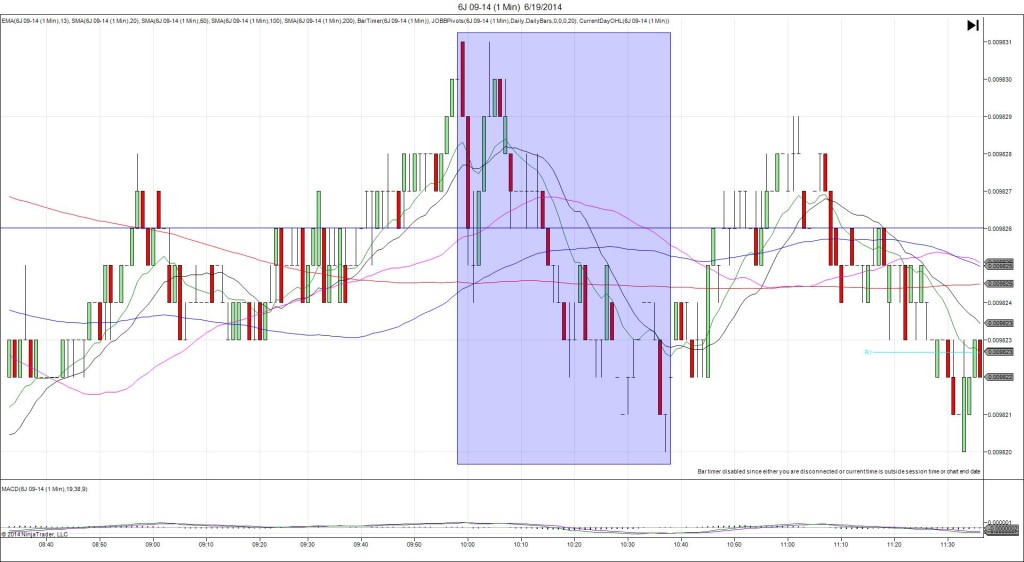

SPIKE WITH 2ND PEAK

Started @ 106.17

1st Peak @ 105.81 – 1031:39 (2 min)

36 ticks

Reversal to 105.98 – 1033 (3 min)

17 ticks

2nd Peak @ 105.60 – 1037 (7 min)

57 ticks

Reversal to 106.06 – 1049 (19 min)

46 ticks

Final Peak @ 105.36 – 1122 (52 min)

81 ticks

Reversal to 105.93 – 1212 (102 min)

57 ticks

Notes: Nearly matching negligible draw in inventories, while gasoline saw a negligible gain when a negligible draw was expected, and distillates saw a near matching negligible gain. Overall, the results did not differ much from the forecasts, but they were in line to cause a slow developing short reaction. This resulted in a 36 tick short spike that fell to cross the HOD over 2 bars. With JOBB and a 10 tick buffer, your short order would have filled at 106.07 with no slippage then seen it chop around your fill point and the PP Pivot for about 30 sec before it fell to eclipse the LOD. You could be conservative and look to exit near breakeven or with a small profit, but with consistent results to cause a bearish reaction, it would be prudent to wait for the subsequent drop and target the LOD for about 20 ticks. After that it reversed for 17 ticks on the :33 bar, then fell for a 2nd peak of 21 more ticks as it crossed the S1 Mid Pivot. Then it reversed for 46 ticks to the 50 SMA and OOD in the next 12 min. After that it fell for a final peak of 24 more ticks to reach the S1 Pivot. Then the bulls took over on the reversal of 57 ticks in the next hour that reached the 200 SMA.