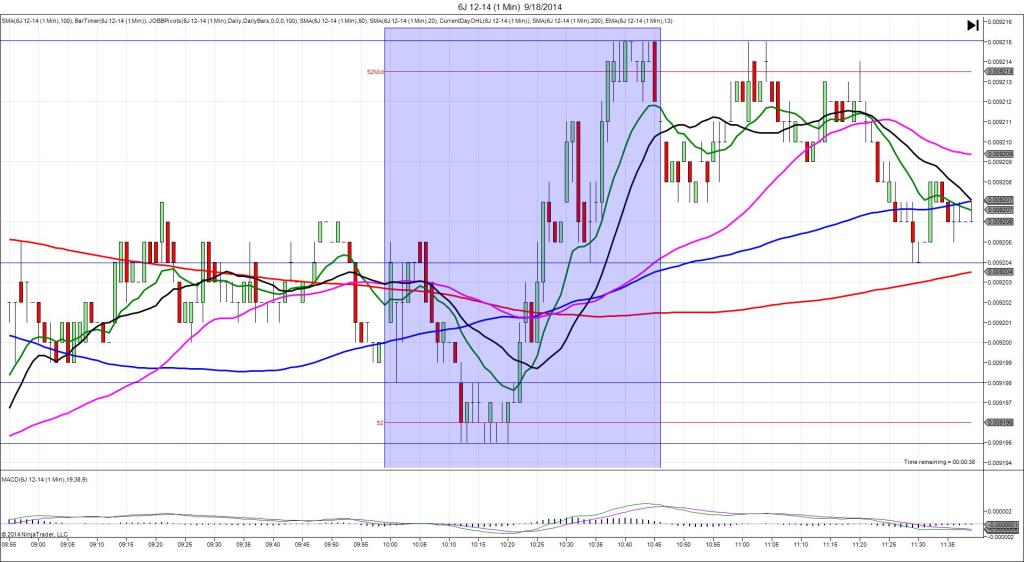

9/18/2014 Weekly Unemployment Claims (0830 EDT)

Forecast: 312K

Actual: 280K

TRAP TRADE – DULL NO FILL (SPIKE WITH 2ND PEAK)

Anchor Point @ 0.009194 (last price)

————

Trap Trade:

)))1st Peak @ 0.009192 – 0830:04 (1 min)

)))-2 ticks

)))Reversal to 0.009196 – 0830:27 (1 min)

)))4 ticks

————

2nd Peak @ 0.009185 – 0835 (5 min)

9 ticks

Reversal to 0.009204 – 0843 (13 min)

19 ticks

Trap Trade Bracket setup:

Long entries – 0.009186 (No SMA / Pivot near) / 0.009176 (No SMA / Pivot near)

Short entries – 0.009204 (on the 100 SMA) / 0.009213 (just below the S2 Mid Pivot)

Notes: Report came in strong with 32k offset but was coupled with a weak building permits / housing starts report. This must have created a perfect equilibrium initially as we only saw a 2 tick short move. This would have fallen several ticks short of the inner short entry, so cancel the order. It eventually fell for a 2nd peak of 7 more ticks after 4 more min (on the claims news), then reversed 19 ticks to the 100 SMA (on the permits/housing data).