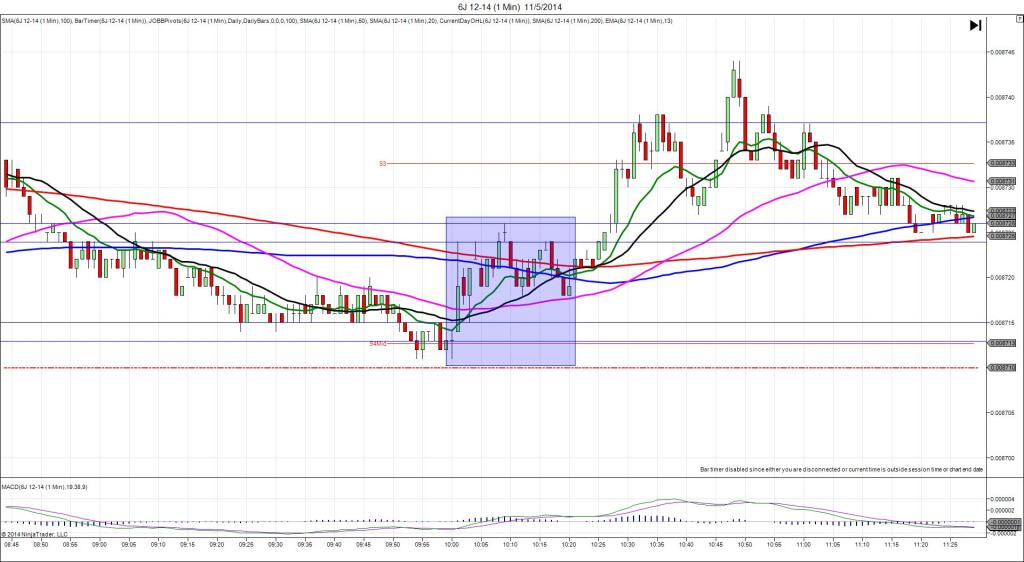

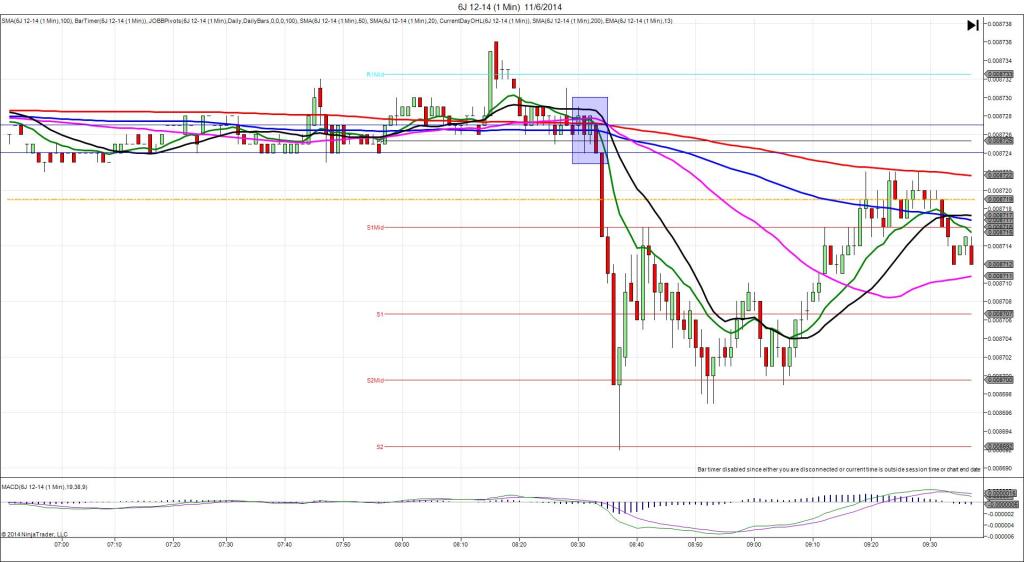

10/30/2014 7-yr Bond Auction (1301 EDT)

Previous: 2.24/2.5

Actual: 2.02/2.4

SPIKE WITH 2ND PEAK

Started @ 141’22 (1301)

1st Peak @ 141’18 – 1301:38 (1 min)

4 ticks

Reversal to 141’23 – 1305 (4 min)

5 ticks

2nd Peak @ 141’13 – 1325 (24 min)

9 ticks

Reversal to 141’22 – 1347 (46 min)

9 ticks

Notes: Report is not found on Forex Factory, but the spike always breaks after 1:30 min late as with other bond auctions. The highest yield of 2.02 fell substantially from last month while the bid to cover ratio tapered slightly to 2.4. This caused a small short reaction that fell 4 ticks with no barrier near. With JOBB, you would have been filled short at 141’20 with no slippage, then had an opportunity to exit with 1-2 ticks as it hovered just after the spike. Then it reversed 5 ticks in 3 min back to the 20 SMA before falling for a 2nd peak of 5 more ticks to the R1 Mid Pivot in 20 min. Then it reversed 9 ticks in 22 min, back to the 100 SMA.