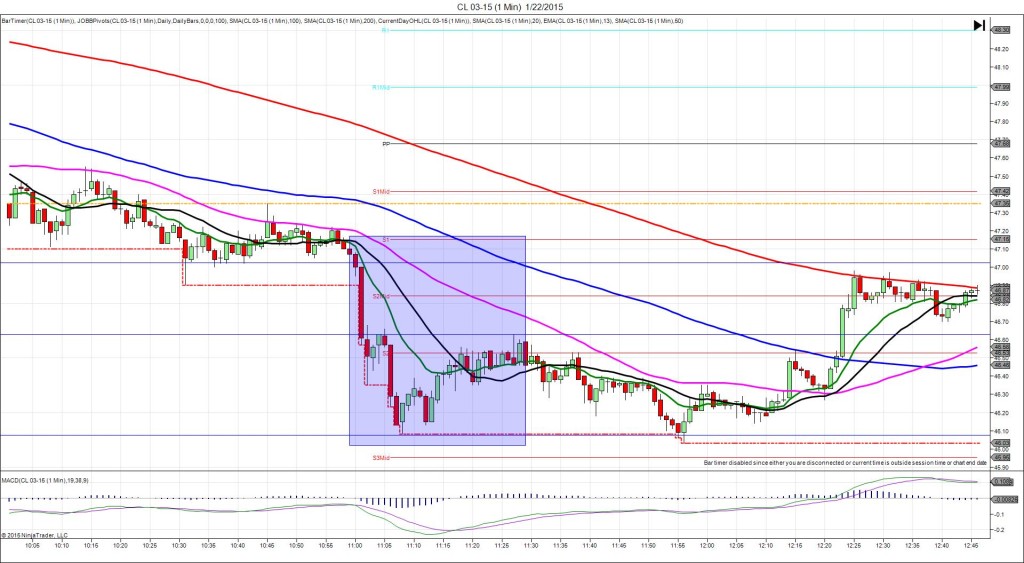

1/29/2015 Weekly Natural Gas Storage Report (1030 EST)

Forecast: -113B

Actual: -94B

SPIKE WITH 2ND PEAK

Started @ 2.854

1st Peak @ 2.729 – 1031:36 (2 min)

125 ticks

Reversal to 2.753 – 1036 (6 min)

24 ticks

2nd Peak @ 2.680 – 1056 (26 min)

174 ticks

Reversal to 2.705 – 1107 (37 min)

25 ticks

Notes: We saw a smaller draw on the reserve compared to the forecast which caused a large short move that was slow developing. With JOBB and a 10 tick bracket, your short order would have filled around 2.816 with 28 ticks of slippage. It continued to trickle lower then hover near the S2 Pivot early in the :32 bar to allow up to 80 ticks to be captured. Then it reversed 24 ticks in 4 min before falling for a 2nd peak of 49 more ticks in 20 min as it crossed the S3 Mid Pivot. Then it reversed 25 ticks in 11 min after crossing the 13/20 SMAs.