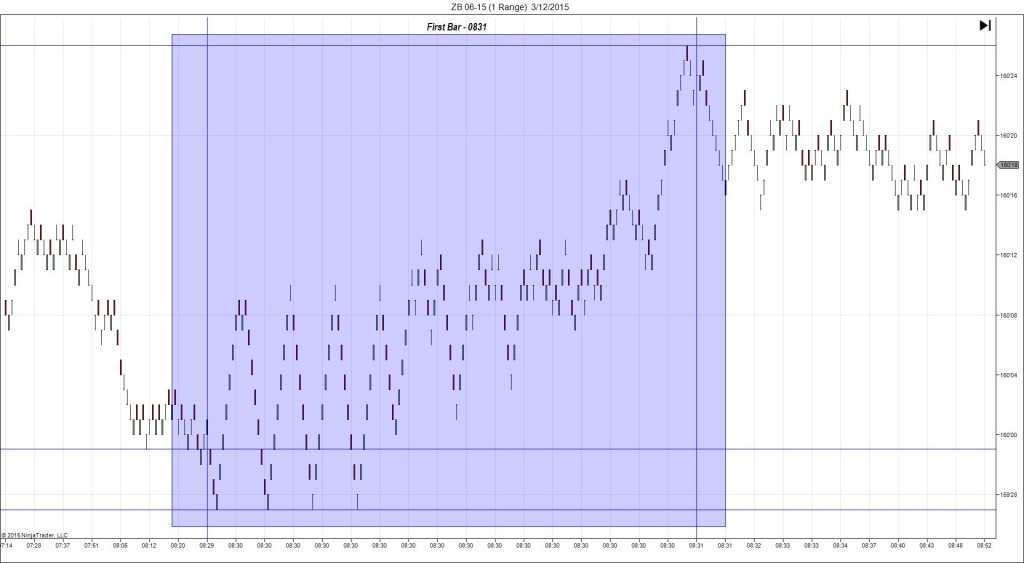

3/12/2015 Monthly Retail Sales (0830 EDT)

Core Forecast: 0.6%

Core Actual: -0.1%

Previous revision: -0.2% to -1.1%

Regular Forecast: 0.3%

Regular Actual: -0.6%

Previous Revision: n/a

INDECISIVE

Started @ 159’31

Wrong Direction spike to 159’27 – 0830:01 (1 min)

4 ticks

1st Peak @ 160’26 – 0830:51 (1 min)

27 ticks

Reversal to 160’15 – 0833 (3 min)

11 ticks

Continued Reversal to 160’09 – 0906 (36 min)

17 ticks

Pullback to 160’25 – 0925 (55 min)

16 ticks

Reversal to 159’30 – 1011 (101 min)

27 ticks

Notes: Report was extremely weak for a second straight month. After seeing the retail results trending to overshadow the claims lately when double booked, we shifted to the bracket approach which would have also fared better last month. Well, manipulation came into play here similar to the NFP as we saw a 4 tick short move followed by whipsaw conditions for 2 sec, then a nice long spike for 27 ticks to the R2 Pivot which is excessively large for this report. The claims offset the report and may have been responsible for the opening indecision. With JOBB and a 3 tick bracket, your short order would have filled at 159’27 with 1 tick of slippage, then you would have been immediately stopped out with a 5 tick loss (including 1 tick of slippage). The tight stop would have been useful here for protection. With such an oversized spike, you can expect a good reversal. We saw a 11 tick drop in the next 2 min to the R2 Mid Pivot, then another 6 ticks in the next 33 min to the 200 SMA. Then it pulled back 16 ticks for nearly a double top in 19 min before reversing 27 ticks to the origin in 46 min. So even with the loss on the initial trade, it was a good scenario to trade a reversal and more than make up for the loss.