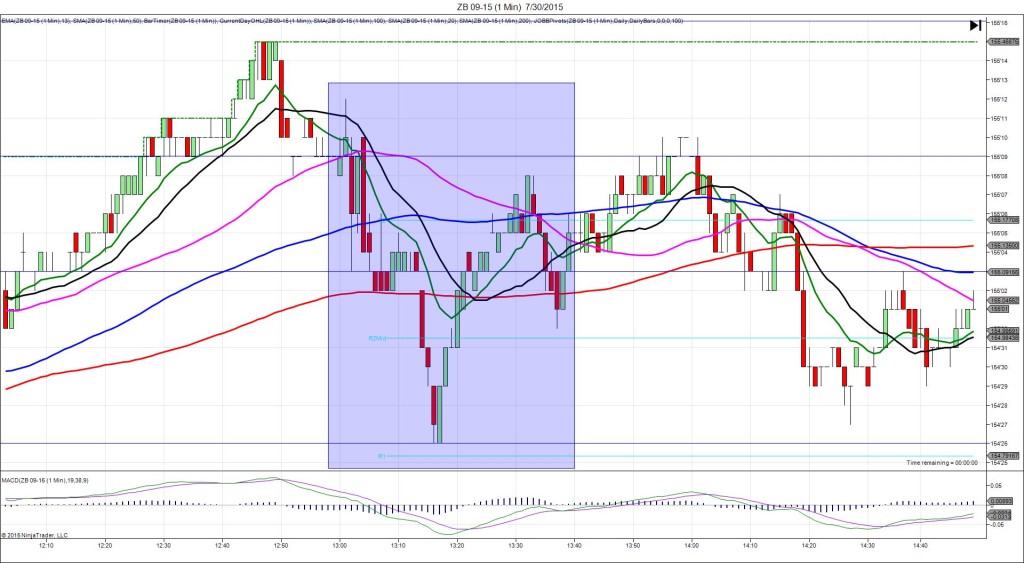

7/30/2015 Quarterly Advance GDP (0830 EDT)

Forecast: 2.6%

Actual: 2.3%

Previous Revision: -0.4% to 0.2%

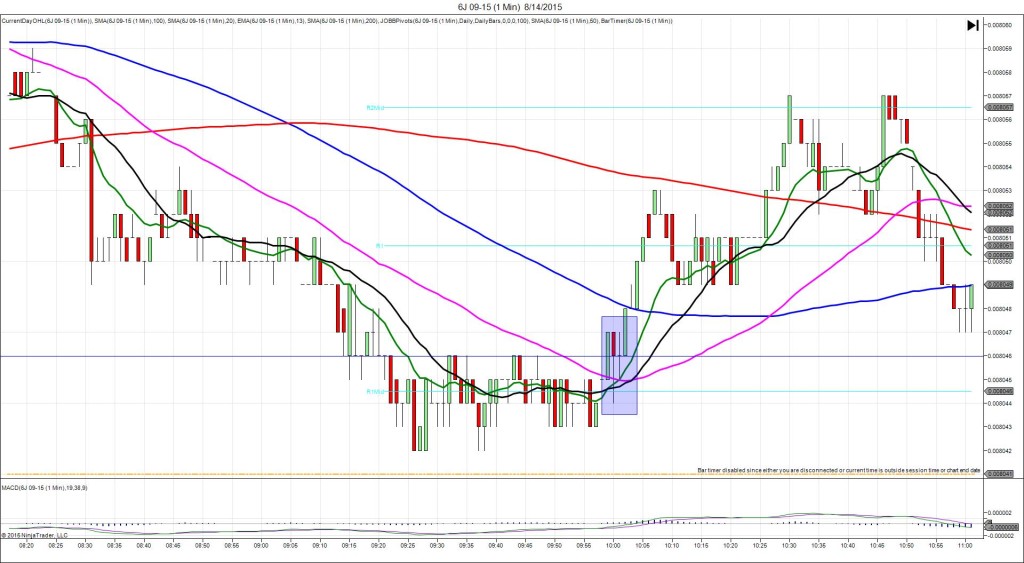

TRAP TRADE – INNER TIER

Anchor Point @ 153’28 (last price)

————

Trap Trade:

)))1st Peak @ 154’11 – 0830:03 (1 min)

)))15 ticks

)))Reversal to 153’18 – 0830:30 (1 min)

)))-25 ticks

)))Pullback to 153’28 – 0831:17 (2 min)

)))10 ticks

)))Reversal to 153’19 – 0831:21 (2 min)

)))-9 ticks

————

2nd Peak @ 155’00 – 0902 (32 min)

36 ticks

Reversal to 154’18 – 0916 (46 min)

14 ticks

Final Peak @ 155’09 – 0948 (78 min)

45 ticks

Reversal to 154’18 – 1031 (121 min)

23 ticks

Trap Trade Bracket setup:

Long entry – 153’16 (just above the S2 Pivot)

Short entry – 154’08 (just above the HOD)

Notes: Report came in weak as it fell short of the mediocre forecast by 0.3%. This caused a quick long spike of 15 ticks in 3 sec that touched the PP Pivot and extended the HOD before reversing. This would have filled the short entry with 3 ticks to spare then allowed up to 21 ticks to be captured as it reversed 28 ticks in 27 sec. A target below the 200 SMA would have yielded 13 ticks and a target below the S2 Mid Pivot would have yielded 18 ticks. After that it pulled back 10 ticks in 47 sec to the 200 SMA before reversing 9 ticks in 4 sec to hover below the S2 Mid Pivot. Then it climbed for a 2nd peak of 21 more ticks in 30 min as it reached the R2 Mid Pivot before reversing 14 ticks in 14 min to the R1 Mid Pivot in 14 min. After that it climbed for a final peak of 9 more ticks in 32 min as it eclipsed the R2 Pivot before reversing 23 ticks in 33 min.