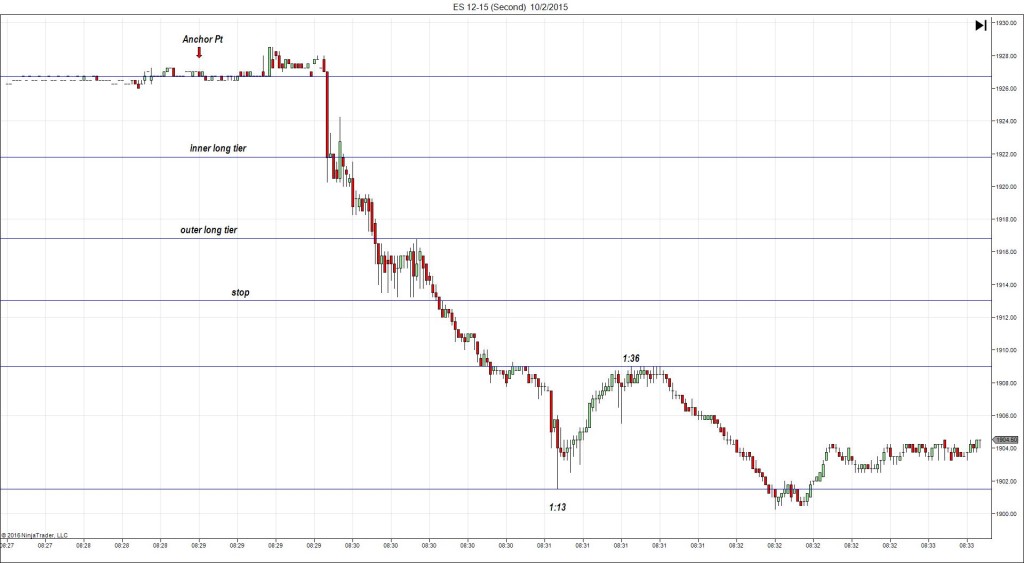

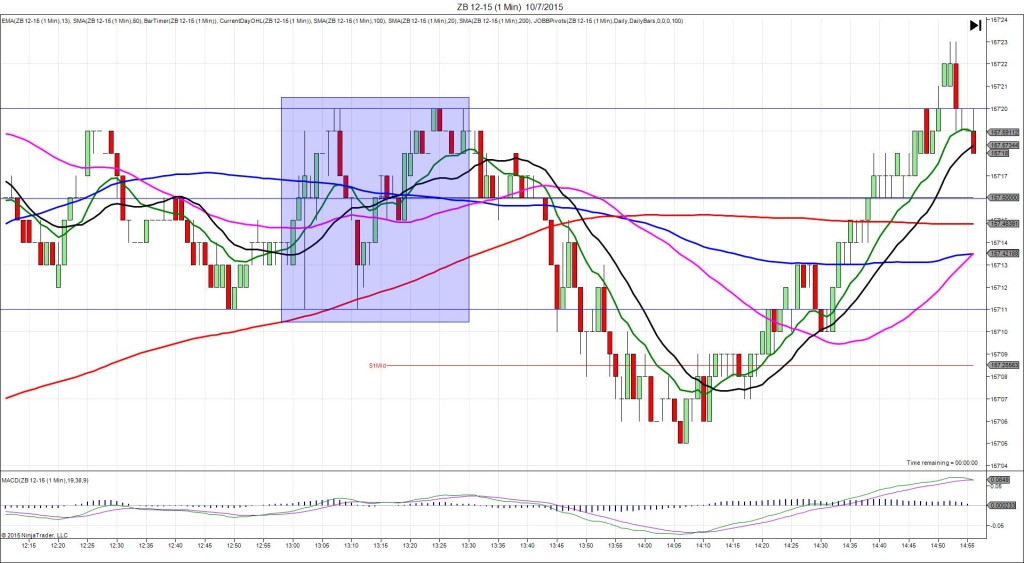

8/27/2015 Quarterly Prelim GDP (0830 EDT)

Forecast: 3.2%

Actual: 3.7%

Previous Revision: n/a

TRAP TRADE – OUTER TIER DULL FILL

Anchor Point @ 156’11

————

Trap Trade:

)))1st Peak @ 155’31 – 0830:09 (1 min)

)))-12 ticks

)))Reversal to 156’04 – 0830:18 (1 min)

)))5 ticks

)))Pullback to 155’28 – 0831:45 (2 min)

)))8 ticks

————

Reversal to 156’12 – 0836 (6 min)

16 ticks

Final Peak @ 155’16 – 0911 (41 min)

28 ticks

Reversal to 156’19 – 1004 (94 min)

35 ticks

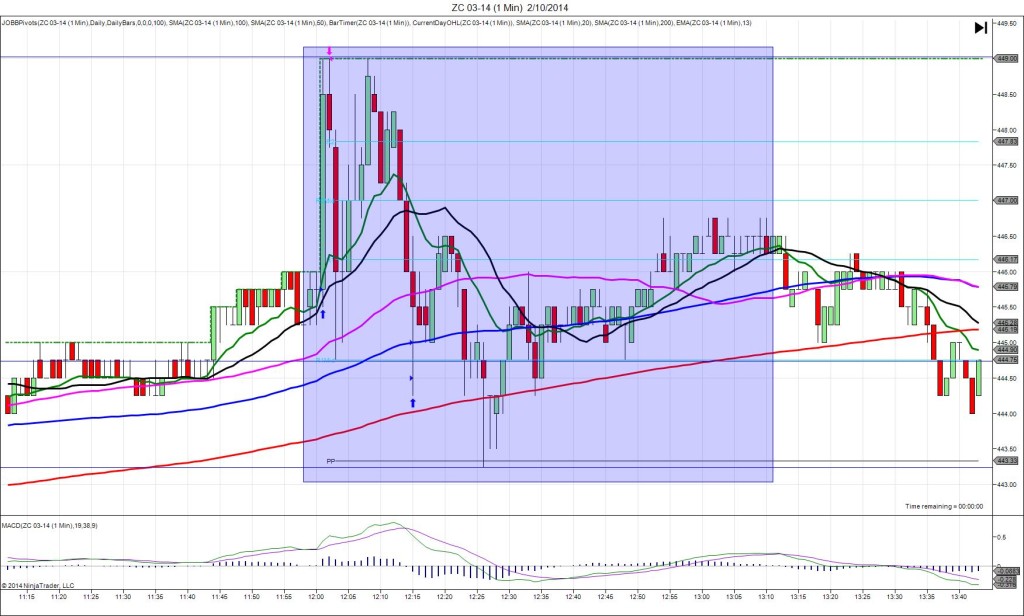

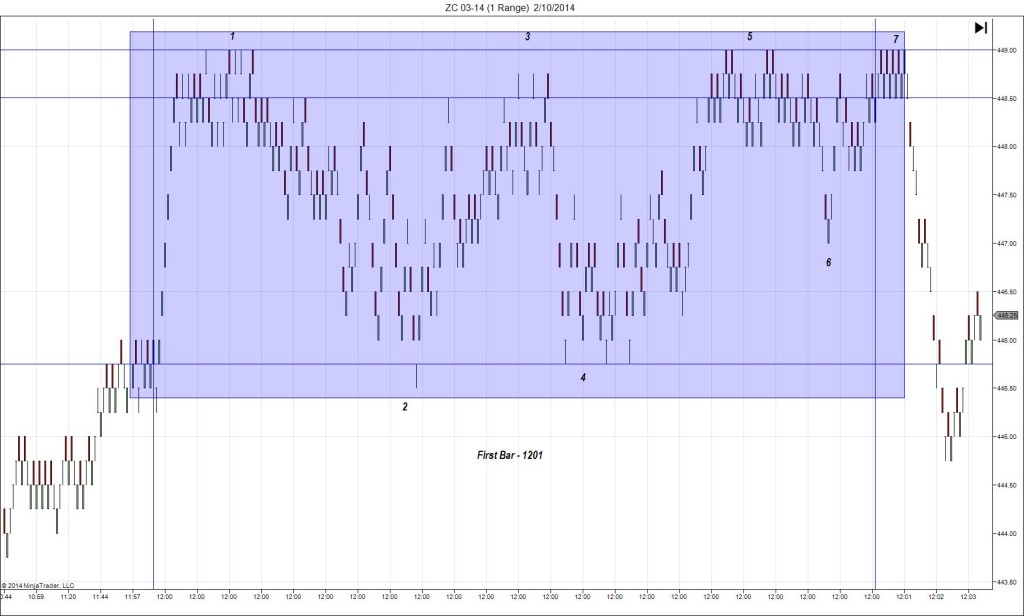

Trap Trade Bracket setup:

Long entries – 156’07 (just below the 50 SMA)/ 156’03 (on the OOD)

Short entries – 156’16 (No SMA / Pivot near) / 156’19 (in between the 200 SMA / PP Pivot)

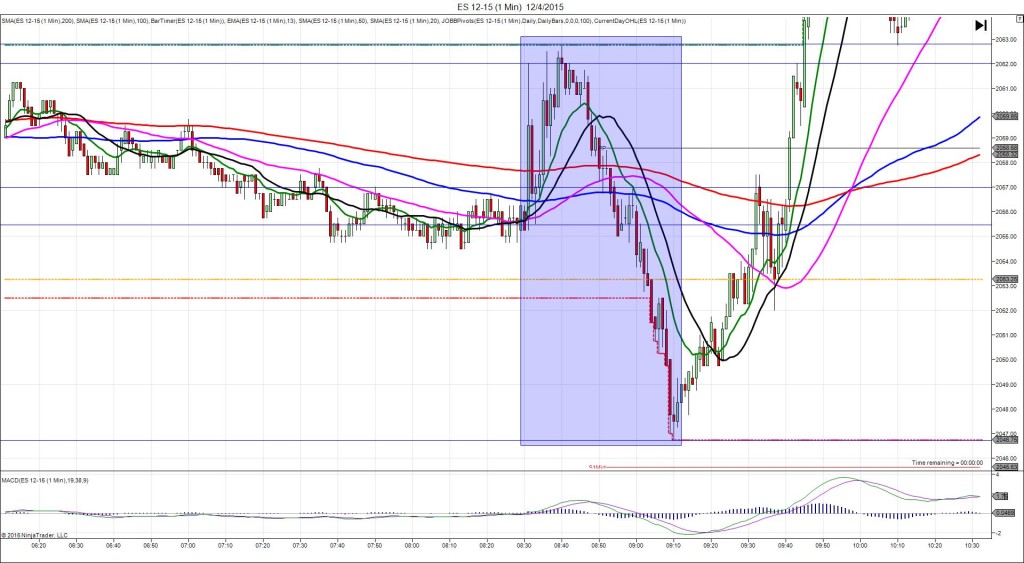

Notes: Report exceeded the forecast by 0.5%, causing a large short spike of 12 ticks in 9 sec that started on the 100 SMA and fell to cross the S1 Mid Pivot before reversing. This would have filled the inner and outer long entries making an average long position of 156’05. As it reversed, it climbed only 5 ticks and hovered 9 for 9 sec to allow an exit with 1-2 ticks loss for a total loss of 2-4 ticks. After that it continued to fall for 8 ticks to the LOD before reversing 16 ticks in 4 min to the 100 SMA. Then it fell for a final peak of 13 more ticks in 35 min as it extended the LOD before reversing 35 ticks in 53 min.in 34 sec then hovered at 155’06 (the inner short tier) to allow 21 total ticks to be captured. After that it pulled back 6 ticks in 1 min before reversing 15 ticks in 33 min. Then it pulled back 8 ticks in 9 min to the 50 SMA.