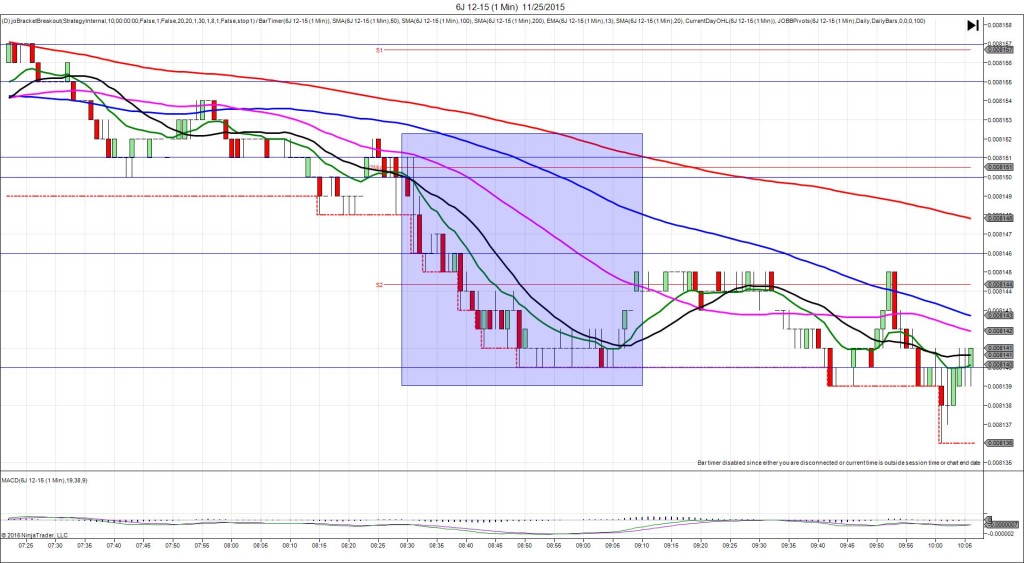

12/2/2015 Weekly Crude Oil Inventory Report (1030 EST)

Forecast: -0.47M

Actual: 1.18M

Gasoline

Forecast: 1.45M

Actual: 0.14M

Distillates

Forecast: 0.33M

Actual: 3.05M

SPIKE WITH 2ND PEAK

Started @ 41.30

1st Peak @ 40.93 – 1030:20 (1 min)

37 ticks

Reversal to 41.13 – 1030:58 (1 min)

20 ticks

2nd Peak @ 40.77 – 1036 (6 min)

53 ticks

Reversal to 41.26 – 1048 (18 min)

49 ticks

Final Peak @ 39.84 – 1418 (228 min)

146 ticks

Expected Fill: 41.19 (short)

Slippage: 1 tick

Best Initial Exit: 40.94 – 25 ticks

Recommended Profit Target placement: 40.87 (just below the LOD) – move slightly higher

Notes: 1st peak had to cross several layers of support, so expect a reversal after hovering. After the 2nd peak, it reversed to the S1 Pivot before trending lower for almost 4 hours.