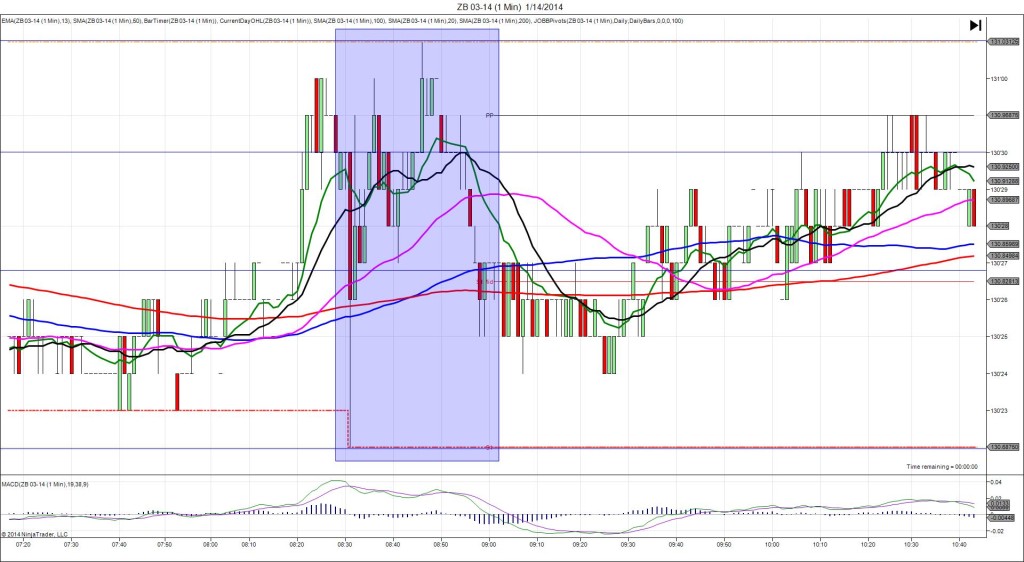

1/15/2013 FED Beige Book (1400 EST)

Forecast: n/a

Actual: n/a

DULL REACTION (No Fill)

Started @ 94.40

1st Peak @ 94.53 – 1405 (5 min)

13 ticks

Reversal to 94.14 – 1430 (30 min)

39 ticks

Notes: The Federal Reserve said today that economic activity continued to expand at a moderate pace during the reporting period of late November through the end of the year. Nine Districts reported moderate growth rates in economic activity as during the previous reporting period, while modest growth was reported in the Philadelphia and Boston districts, and Kansas City reported no change. The DX had minimal movement, and mostly chopped sideways. This resulted in only a 4 tick move in the first two bars, so cancel the order with no fill. If you had used JOBB and not cancelled, it would have filled on the :03 bar, then given a handful of ticks on the :05 bar as it briefly broke out above the 100/50 SMAs. After that a long and slow developing reversal yielded 39 ticks as it crossed all 3 major SMAs and the R3 Pivot as the pit closed. Then volume and price action dried up as it pulled back up.