9/25/2013 Monthly Durable Goods Orders (0830 EDT)

Core Forecast: 1.1%

Core Actual: -0.1%

Previous revision: -0.2% to -0.8%

Regular Forecast: 0.0%

Regular Actual: 0.1%

Previous Revision: -0.1% to -7.4%

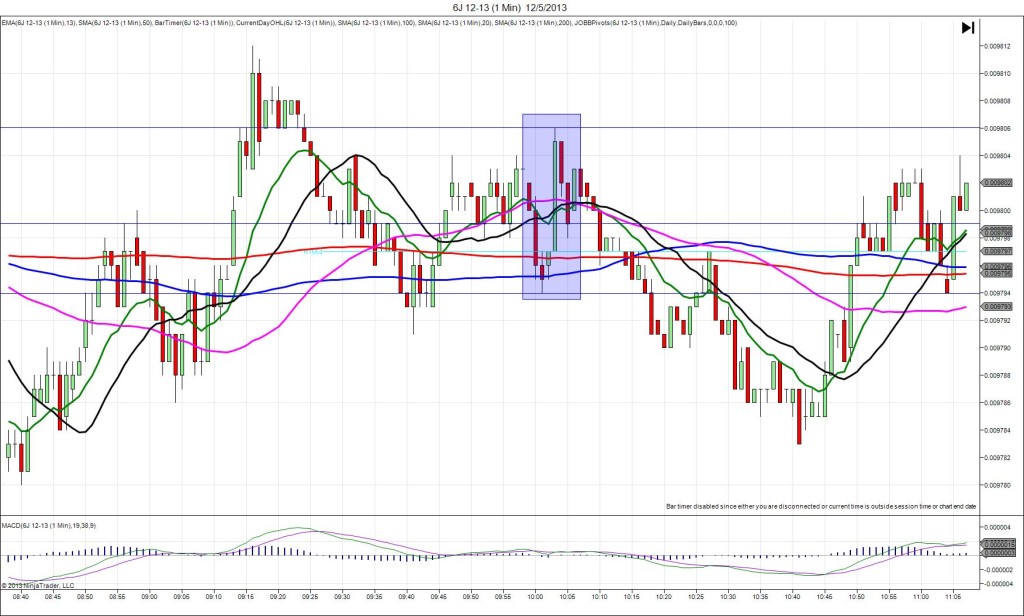

INDECISIVE

Started @ 0.010153

1st peak @ 0.010166 – 0831 (1 min)

13 ticks

Reversal to 0.010150 – 0831 (1 min)

-16 ticks

Extended Reversal to 0.010128 – 0912 (42 min)

38 ticks

Notes: Report came in mostly bearish and disappointed the market with a near match on the regular reading. This caused an unsustainable 13 tick long spike that peaked on the :31 bar, then reversed for 16 ticks immediately as an indecisive reaction. With JOBB, you would have filled long at about 0.010159 with 2 ticks of slippage, then seen it peak and reverse to hit the stop loss for a 6 tick loss with 1 tick of slippage. After 2 cycles from the extremes of the bar, it fell into a long slow developing reversal for another 22 ticks in the next 40 min, crossing the PP Pivot.