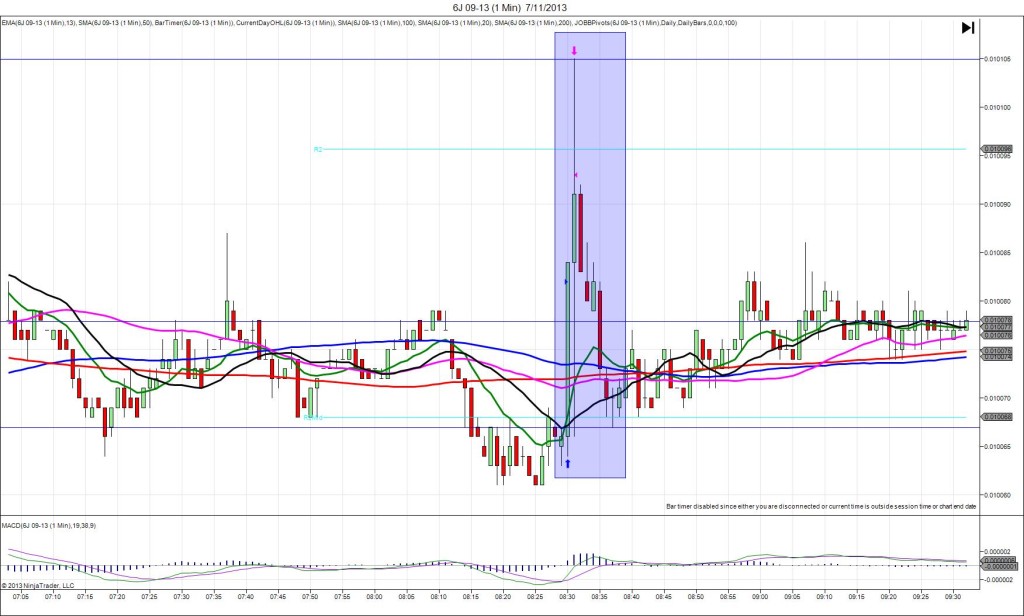

7/18/2013 Weekly Unemployment Claims (0830 EDT)

Forecast: 344K

Actual: 334K

SPIKE/REVERSE

Started @ 0.009983

1st Peak @ 0.009965 – 0831 (1 min)

18 ticks

Reversal to 0.009983 – 0841 (11 min)

18 ticks

Notes: Report came in better than the forecast by 10k jobs, causing a short spike of 18 ticks. It used the 50 SMA as resistance to spring the fall as it crossed the S2 Mid Pivot and extended the LOD 3 ticks. With JOBB, your short order would have filled at 0.009978 with 1 tick of slippage. Look to exit at the LOD around 0.009968 for 10 ticks as it also hovered in the vicinity for about 8 sec. After pulling back and chopping sideways, it reversed back to the origin and the 50 SMA for 18 ticks in the next 10 min. Then it trended lower and achieved a double bottom 30 min later.