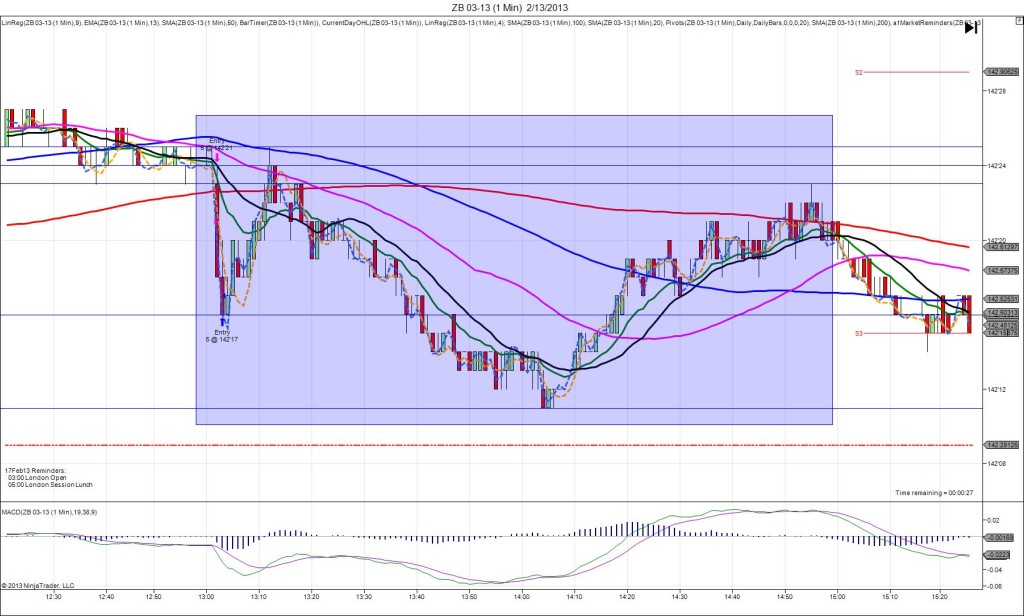

2/13/2013 10-yr Bond Auction (1301 EST)

Previous: 1.86/2.8

Actual: 2.05/2.7

SPIKE WITH 2ND PEAK

Started @ 142’24 (1301)

1st Peak @ 142’16 – 1303 (2 min)

8 ticks

Reversal to 142’25 – 1312 (11 min)

9 ticks

2nd Peak @ 142’11 – 1404 (63 min)

13 ticks

Reversal to 142’23 – 1455 (114 min)

12 ticks

Notes: Report is scheduled on Forex Factory at the top of the hour, but the spike always breaks 1 min late. The highest yield rose strongly from the previous auction 1 month after the FED commenced buying bonds. This caused the ZB to spike short for 8 ticks. With JOBB you would fill short at 142’21 with no slippage. It only crossed the 200 SMA near the origin, but bottomed at the S3 Pivot, a strong support barrier. I noticed the S3 Pivot and elected to get out with 4 ticks at 142’17, as I thought it would struggle to go much lower. After the spike, it reversed back to the origin, then fell again for a slow developing 2nd peak of 5 more ticks (2 ticks above the LOD) in about 50 min. The final reversal reclaimed 12 ticks in about an hour, just above the 200 SMA.