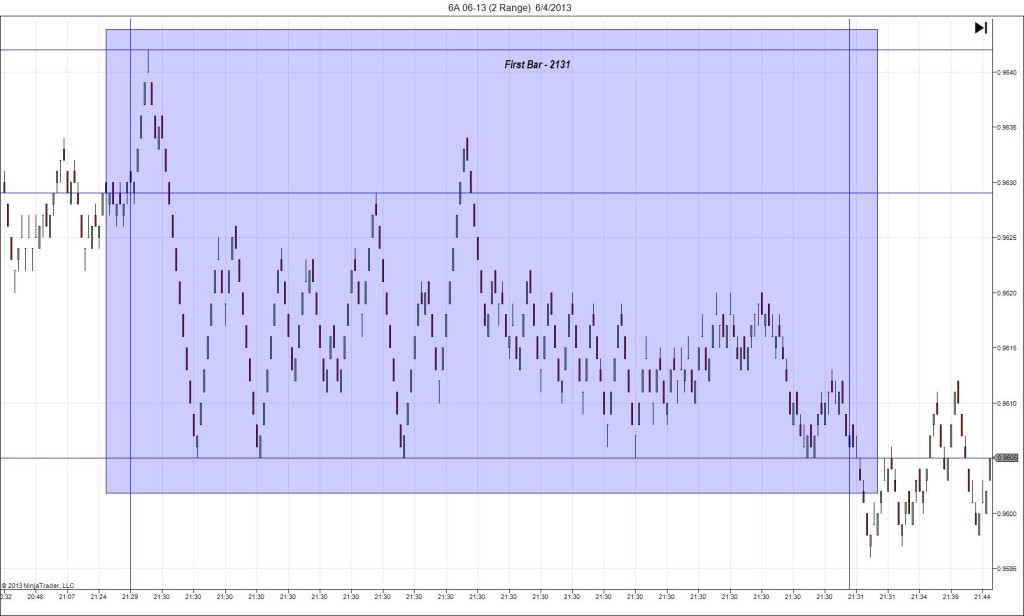

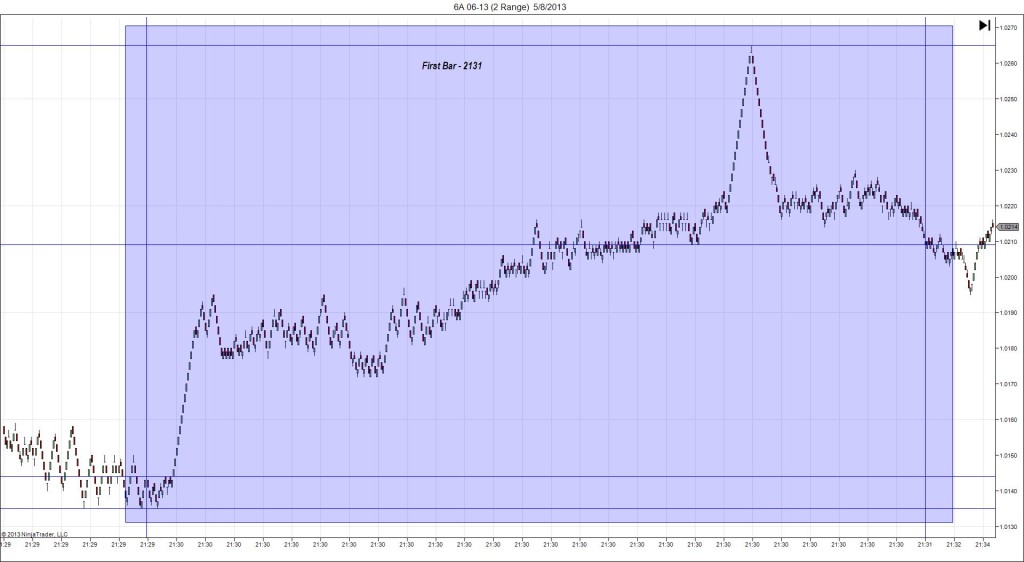

5/6/2013 Monthly Retail Sales (2130 EDT)

Forecast: 0.20B

Actual: 0.31B

Previous Revision: +0.07B to -0.11B

INDECISIVE

Started @ 1.0213

1st Peak @ 1.0221 – 2131 (1 min)

8 ticks

Reversal to 1.0203 – 2131 (1 min)

-18 ticks

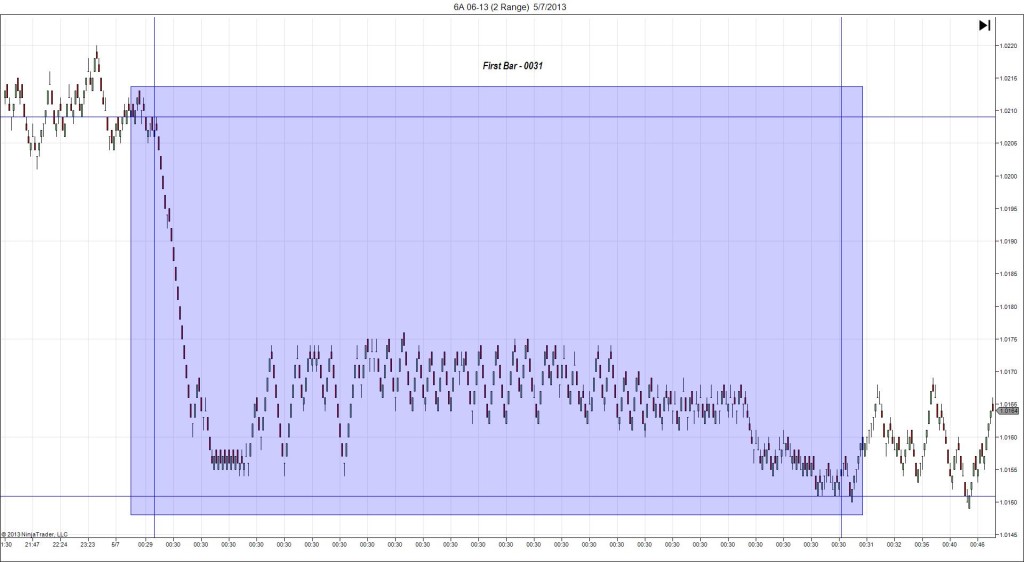

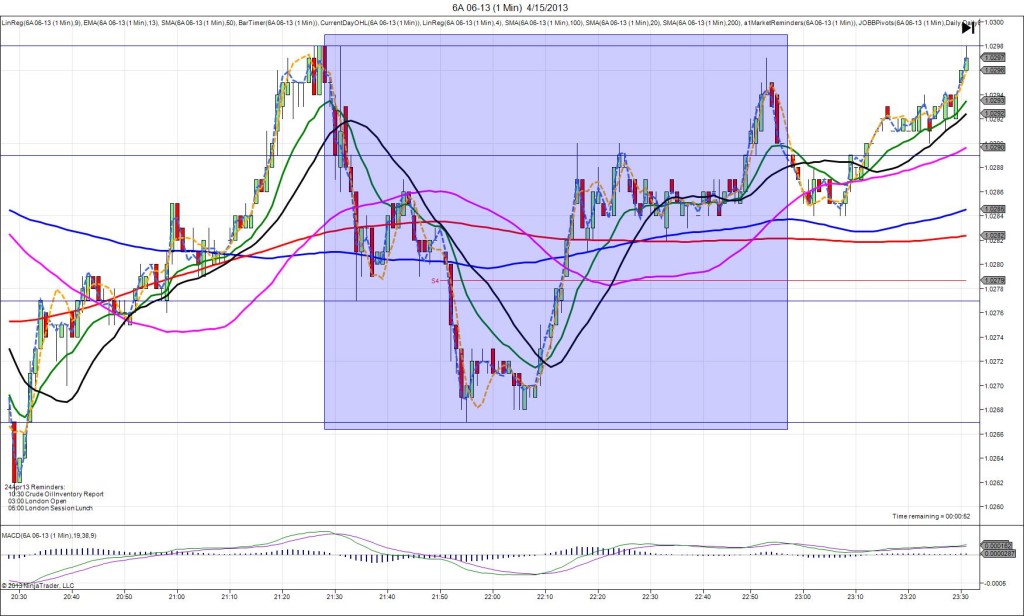

Notes: First, the reason AUS Trade Balance was indecisive was due to a positive Trade balance result and a concurrent extremely negative Quarterly HPI report that had the biggest offset from the forecast in several years. Normally the HPI report is a yawner and has little effect on the market. However, with a mildly positive Trade Balance with a normally larger share of influence coupled with an epically disappointing low influence report, they balanced each other and caused indecision. Here is a reconstruction of what happened:

1. The spike initially went long and filled your long entry with about 2-3 ticks of slippage at 1.0218 with the # of contracts you desired. 2. The spike reversed and headed short while the stop loss from your ATM strategy attached to the long entry was setting up during the brief overlap while the opposite short entry was still on the chart before the OCO function triggered. This caused both the stop and the short entry to fill with about 0-3 ticks of slippage at 1.0210. So your initial fill was stopped for about -8 ticks with the # of contracts you intended to trade and you had an additional # equal to your initial lot fill as short positions at 1.0210. 3. The 5 tick stop loss for the 1.0210 short entry tried to apply at 1.0215 as the market was rebounding long, but was disallowed by NinjaTrader as it was below the market price at that time. 4. Then the knife switch logic in JOBB saw that both entry orders were filled and attempted to flatten all open orders, resulting in closing out your additional short positions for an additional loss of about 9 ticks. So you should have lost about 17 total ticks on this report.

BOTTOM LINE:

This is the second time this scenario has happened (German IFO on 3/22/13 is the other occurrence) where it spikes one way and fills the entry, then reverses during the narrow window when both the stop loss and the opposite entry are on the chart together. The overlap is only about 3/10 of a second according to the programmer, but necessary to have no gap in protection. Fortunately this has only happened twice in about 15 months of JOBB trading over 500 reports. The AUS Trade Balance remains a safe report, but the concurrence of abnormal news caused an undesirable situation this time.