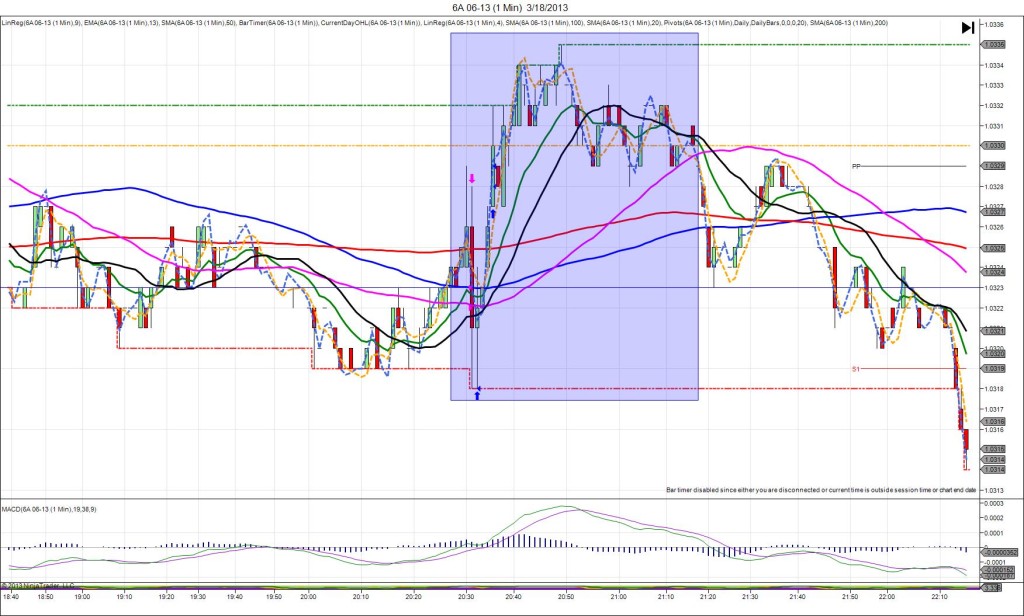

3/18/2013 RBA Monetary Policy Meeting Minutes (2030 EDT)

Forecast: n/a

Actual: n/a

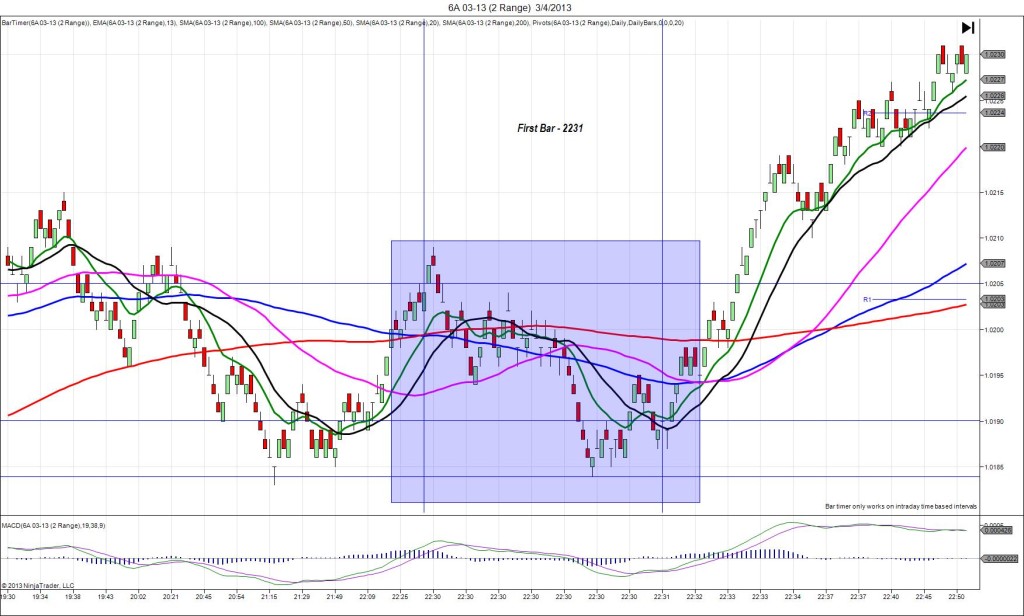

SPIKE/REVERSE

Started @ 1.0326

1st Peak @ 1.0318 – 2031 (1 min)

8 ticks

Reversal to 1.0335 – 2049 (19 min)

17 ticks

Notes: Minutes caused a short spike of only 8 ticks that crossed all 3 SMAs and the S1 Pivot and LOD. Due to several support barriers, it could not sustain the drop and reversed on the latter part of the :32 bar. With JOBB, you would have filled short with no slippage at about 1.0322, then had an opportunity to close out with 3 ticks at the S1 Pivot before it reversed strongly on the following bars. The support barriers were too much to sustain the fall. This followed the same pattern as the Cash Rate from 2 weeks ago, going short, then reversing quickly and strongly past the origin. The reversal was able to capture 17 ticks in 19 min to cross the PP Pivot and extend the HOD 3 ticks. After that it slowly fell again in the next few hours.