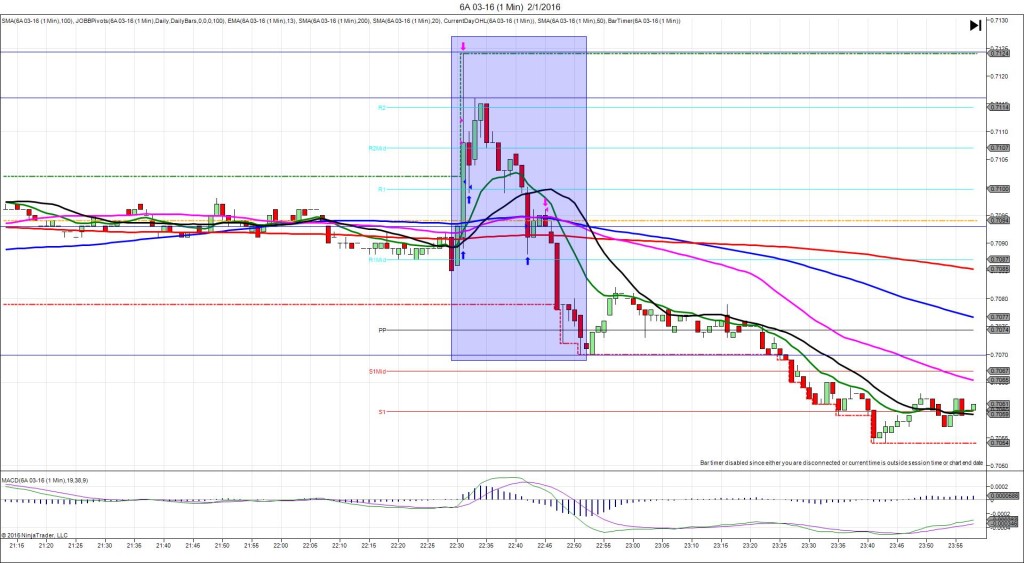

2/2/2016 Monthly Trade Balance (1930 EST)

Forecast: -2.45B

Actual: -3.54B

Previous Revision: +0.18B to -2.73B

TRAP TRADE – INNER TIER

Anchor Point @ 0.7026

————

Trap Trade:

)))1st Peak @ 0.7037 – 1930:03 (1 min)

)))11 ticks

)))Reversal to 0.7018 – 1930:12 (1 min)

)))-19 ticks

————

Continued Reversal to 0.6990 – 1955 (25 min)

47 ticks

Pullback to 0.7005 – 2008 (38 min)

15 ticks

Trap Trade Bracket setup:

Long entries – 0.7019 (in between the S1 Pivot and 50 SMA) / 0.7011 (in between the S2 Mid Pivot and LOD)

Short entries – 0.7033 (just above the S1 Mid Pivot) / 0.7042 (just above the PP Pivot)

Expected Fill: 0.7033 – inner short tier

Best Initial Exit: 0.7019 – 14 ticks (inner long tier)

Recommended Profit Target placement: 0.7019 (inner long tier unmoved)

Notes: Nice conflict with the Trade balance missing the forecast and an equally offsetting Bldg Permits. This caused an ideal whipsaw for the Trap Trade to capture 14 ticks with the inner tiers in 12 sec. After that it continued to fall as the Trade Balance results held sway.