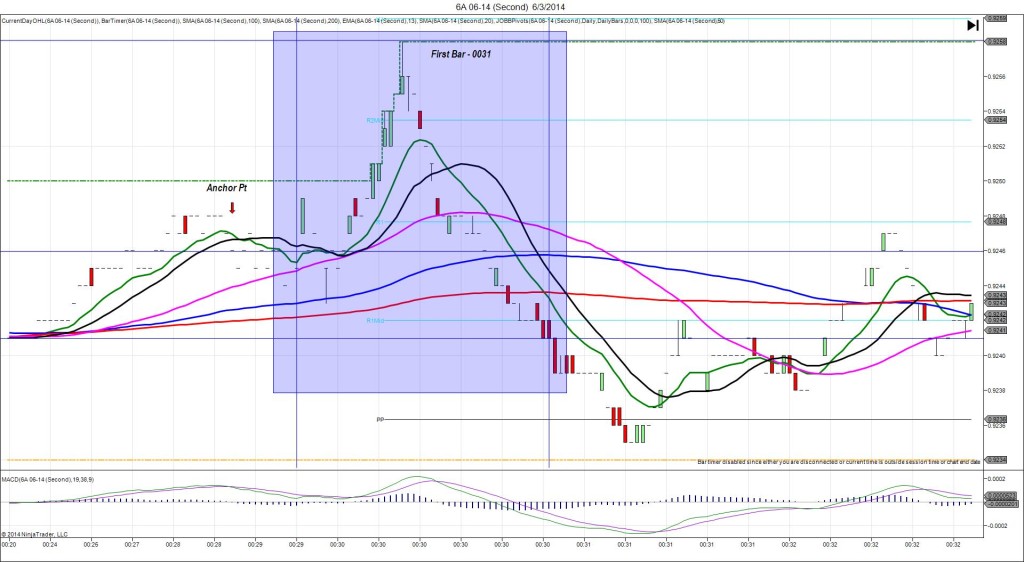

6/3/2014 RBA Rate Statement / Cash Rate (0030 EDT)

Forecast: 2.50%

Actual: 2.50%

TRAP TRADE (SPIKE WITH 2ND PEAK)

Anchor point @ 0.9246

————

Trap Trade:

)))1st Peak @ 0.9258 – 0030:28 (1 min)

)))12 ticks

)))Reversal to 0.9235 – 0031:15 (2 min)

)))-23 ticks

————

Pullback to 0.9254 – 0036 (6 min)

19 ticks

Reversal to 0.9244 – 0040 (10 min)

-10 ticks

Final Peak @ 0.9264 – 0124 (54 min)

18 ticks

Reversal to 0.9258 – 0132 (62 min)

6 ticks

Trap Trade Bracket setup:

Long entries – 0.9235 (just below the PP Pivot) / 0.9224 (just below the S1 Pivot)

Short entries – 0.9258 (just below the R2 Pivot) / 0.9270 (just below the R3 Mid Pivot)

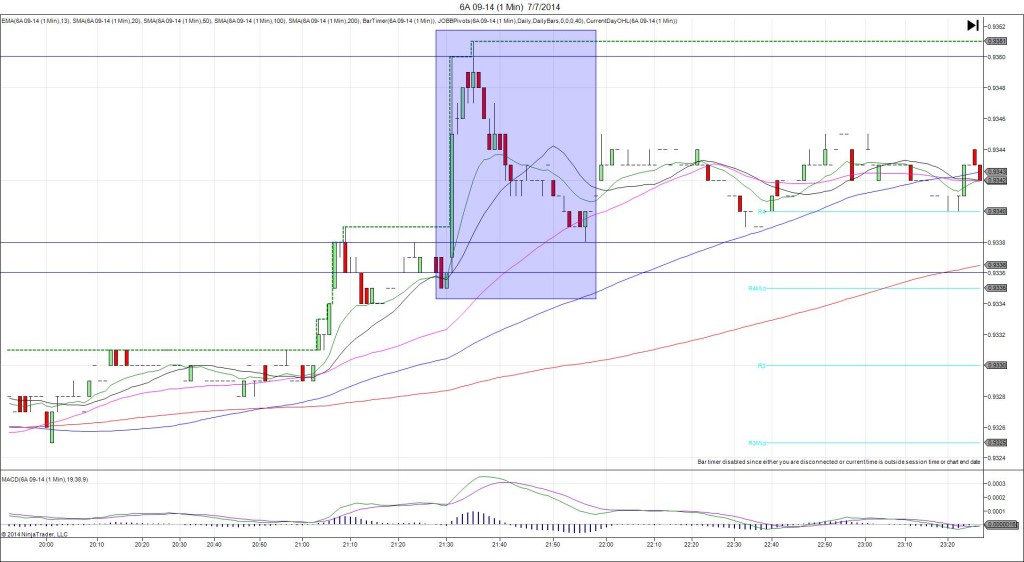

Notes: Australia’s central bank left rates unchanged as expected with no other major changed in policy. This caused a slow developing long spike followed by a reversal midway through the :32 bar, then a rebound and another reversal to make a great trap trade setup. The initial burst long for 12 ticks would have filled the inner short entry tier to the tick, then reversed for 23 ticks allowing an ideal exit near the PP Pivot / 200 SMA for about 22 ticks. After that it pulled back for 19 ticks in the next 5 min to the R2 Mid Pivot. Then it reversed for 10 ticks to the 20 SMA before stepping higher to a final peak of 6 ticks more than the original peak nearly 1 hr after the report, clearing the R2 Pivot and extending the HOD.