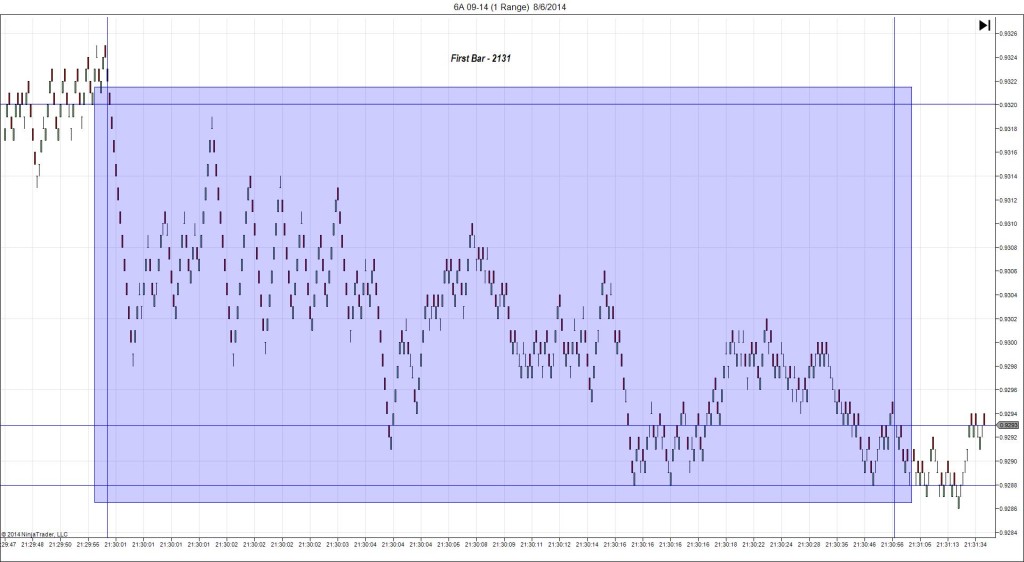

7/14/2014 RBA Monetary Policy Meeting Minutes (2130 EDT)

Forecast: n/a

Actual: n/a

TRAP TRADE

Started @ 0.9343 (last price)

—————-

Trap Trade:

)))1st peak @ 0.9358 – 2130:12 (1 min)

)))15 ticks

)))Reversal to 0.9350 – 2130:18 (1 min)

)))-8 ticks

)))Pullback to 0.9362 – 2131:57 (2 min)

)))12 ticks

—————-

Reversal to 0.9345 – 2142 (12 min)

17 ticks

Trap Trade Bracket setup:

Long entries – 0.9336 (just below the S2 Pivot) / 0.9328 (just below the S3 Mid Pivot)

Short entries – 0.9352 (just above the PP Pivot/200 SMA) / 0.9358 (just above the R1 Pivot)

Notes: Minutes caused a long reaction that rose 15 ticks initially after 12 sec to cross the R1 Pivot and extend the HOD, then back off for 8 ticks seconds later. Depending on the placement of the order, this would have filled your inner tier short entry at 0.9352 then your outer tier after about 30 sec into the bar at 0.9358. While the reversal was strong, it took longer than usual to develop. You may have tried to exit at or just below the R1 Pivot for an exit near breakeven. The better play would have been to at least wait for it to threaten the SMAs and PP Pivot. The :41 bar took a big dive down to the S1 Mid Pivot allowing up to 16-18 total ticks to be captured with an average short position of 0.9355. After that it pulled back to trade near the R1 Mid Pivot.