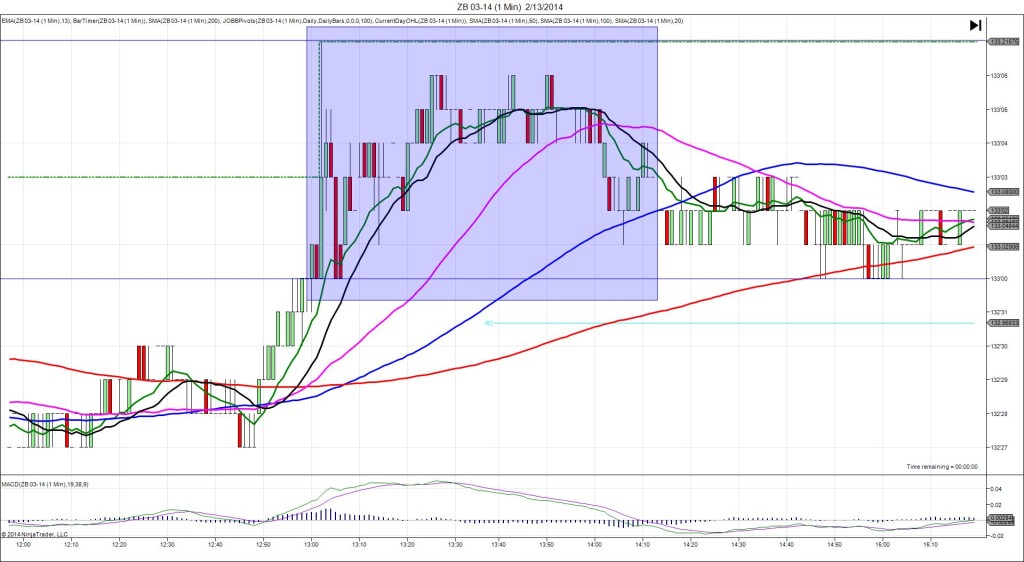

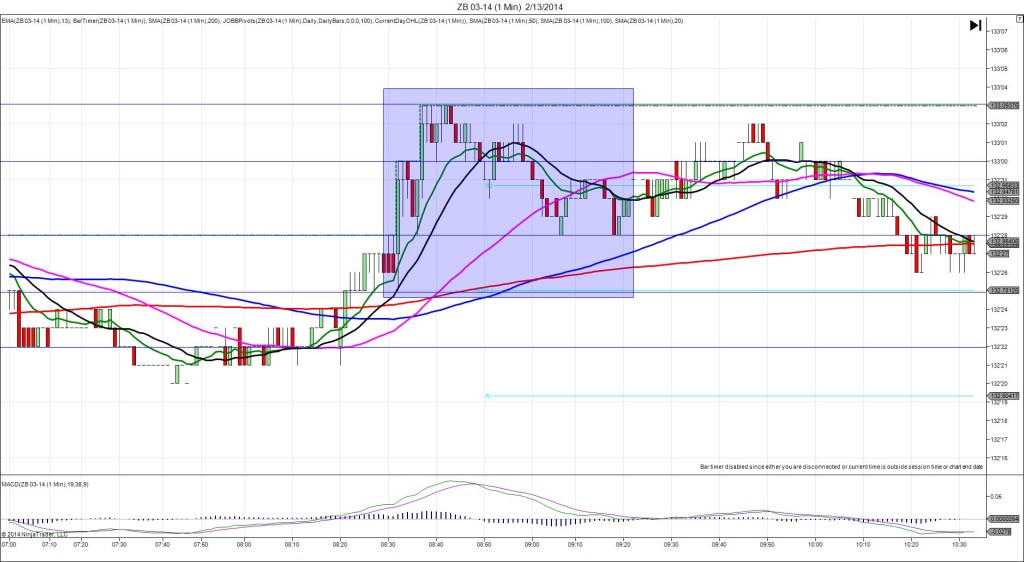

2/12/2014 Monthly Unemployment Report (1930 EST)

Non Farm Jobs Forecast: 15.3K

Non Farm Jobs Actual: -3.7K

Previous Revision: -0.4K to -23.0K

Rate Forecast: 5.9%

Rate Actual: 6.0%

Previous Revision: n/a

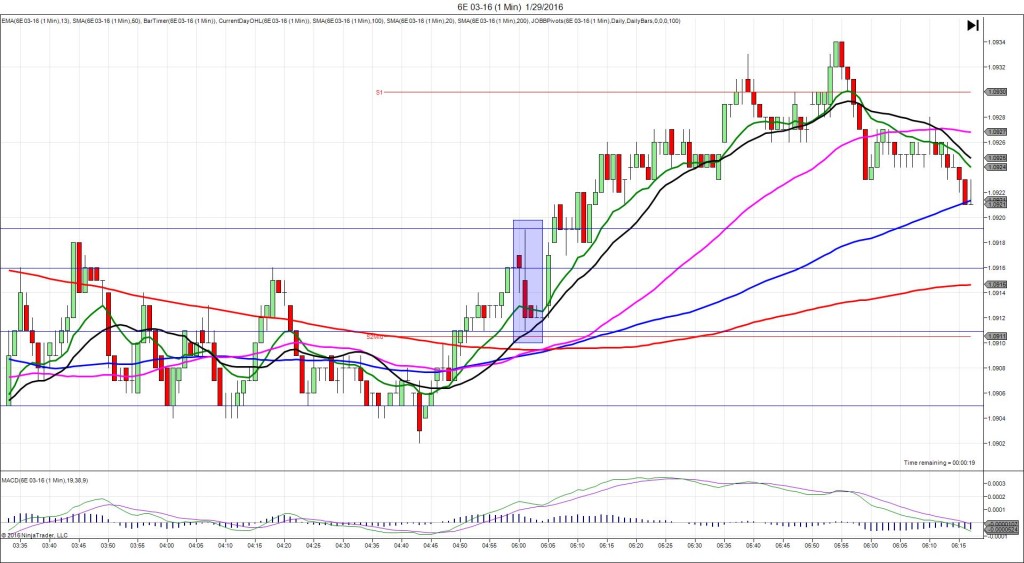

INDECISIVE…DOWNWARD FAN

Started @ 0.8992

Premature spike@ 0.9023 – 1930:00 (1 Min)

31 ticks

1st Peak @ 0.8933 – 1931 (1 min)

90 ticks

Reversal to 0.8948 – 1932 (2 min)

15 ticks

Final Peak @ 0.8910 – 2101 (91 min)

113 ticks

Reversal to 0.8930 – 2213 (163 min)

20 ticks

Notes: Very negative report that fell short of the forecast on jobs created by nearly 19K while the unemployment rate also jumped 0.1%, with a negligible downward revision to the previous report caused a premature long spike followed by the true short move. The 14 tick spike that shot down, rebounded and fell again immediately about 8 sec before the report should have been cause to cancel the order. It was trading sideways near the 200 SMA before the early volatility drove it lower. With JOBB, if you did not cancel, your bracket would have setup with an anchor point at about 0.8992 on the S2 Mid Pivot. Your long entry would have filled at about 0.09008 with 8 ticks of slippage, then you would have been stopped at about 0.8984 with 4 ticks of slippage. It continued lower, crossing the S4 Mid Pivot for a total of 90 ticks from the top of the premature spike or 59 ticks from the origin. Then it reversed 15 ticks on the :32 bar, before continuing lower for a final peak of another 23 ticks in the next 90 min after crossing the S4 Pivot. Then it reversed for a meager 20 ticks in the next 72 min as the volume dried up. This is a case where you can easily make a 2nd peak trade for about 20-25 ticks with a sell limit on the :32 bar reversal after the bearish results are known. A target of the S4 Pivot would be prudent.