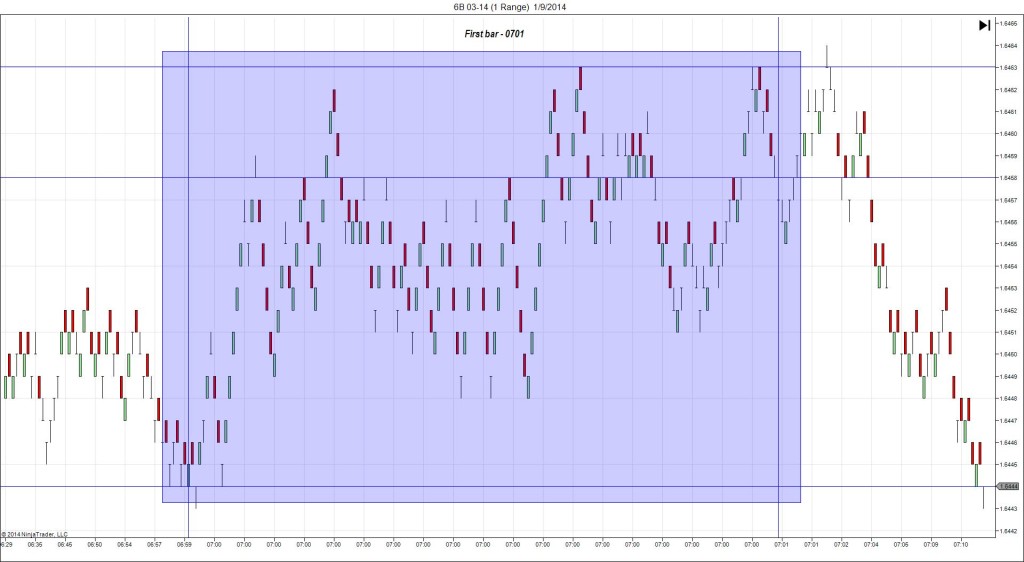

1/9/2014 Official Bank Rate / Asset Purchase Facility (0700 EST)

Forecast: 0.50%

Actual: 0.50%

TRAP TRADE

Started @ 1.6446 (last price)

————

Trap Trade:

1st Peak @ 1.6463 – 0700:06 (1 min)

17 ticks

Reversal to 1.6451 – 0700:15 (1 min)

-12 ticks

2nd Peak @ 1.6464 – 0701:21 (2 min)

19 ticks

————

Reversal to 1.6443 – 0714 (14 min)

21 ticks

Trap Trade Bracket setup:

Long entries – 1.6430 (just below the PP Pivot/LOD) / 1.6418 (just below the S1 Mid Pivot)

Short entries – 1.6463 (no support barrier nearby) / 1.6474 (just above the R1 Pivot)

Notes: The Bank of England left rates unchanged as expected, and the Asset Purchase Facility also remained unchanged. This caused a long move of 17 ticks at the open of the :01 bar in 6 sec, followed by a brief reversal that found support at 1.6451, just below the R1 Mid Pivot at :11 sec. Then it achieved a minor 2nd peak of 1 more tick early in the :02 bar, before pursuing a slow developing reversal in the next 12 min. You may or may not have been filled on the inner short entry as it was right on the threshold. If you were filled, since the reversal often returns to the origin, but you have the SMAs bunched up, an ideal exit would be 1.6450 on the 200 SMA for about 13 ticks. It eventually went another 7 ticks lower, but that was not a certainty, and it labored to get there.