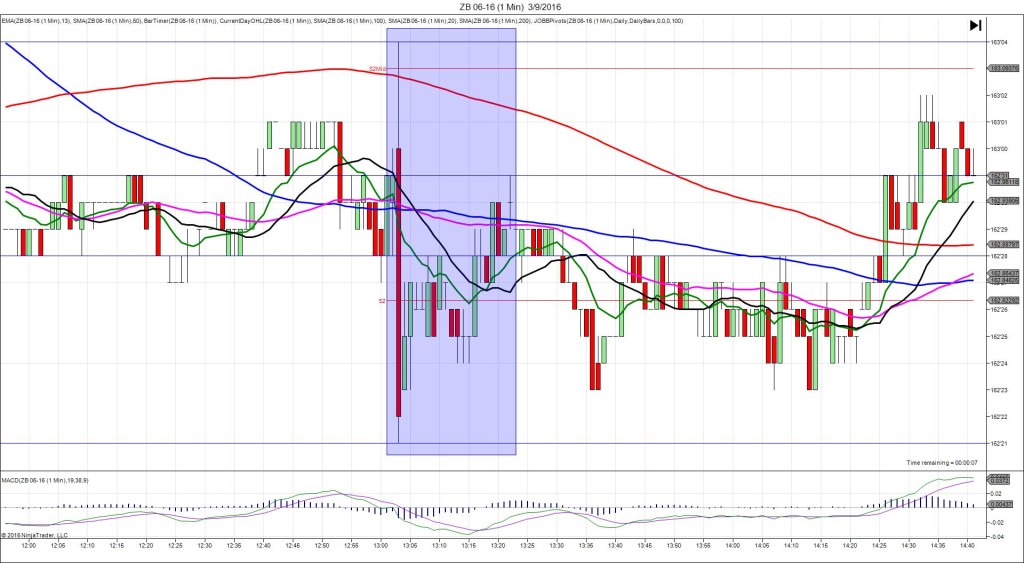

3/15/2016 Monthly Retail Sales (0830 EDT)

Core Forecast: -0.2%

Core Actual: -0.1%

Previous revision: -0.5% to -0.4%

Regular Forecast: -0.1%

Regular Actual: -0.1%

Previous Revision: -0.6% to -0.4%

INDECISIVE

Started @ 162’08

1st Peak @ 162’02 – 0830:00 (1 min)

6 ticks

Reversal to 162’17 – 0830:36 (1 min)

15 ticks

Pullback to 162’09 – 0830:54 (1 min)

8 ticks

Reversal to 162’19 – 0908 (38 min)

10 ticks

Pullback to 162’03 – 0931 (61 min)

16 ticks

Expected Fill: 162’05 (short)

Slippage: 0 ticks

Best Initial Exit: 162’06 – 1 tick loss

Recommended Profit Target placement: 161’30 (just below the R1 Pivot)

Notes: It stabbed lower on the near matching-slightly bullish results with the core reading, but the previous revision was very bearish to give it a conflicting signal. The current reading gets first notice, then the revision, but normally the revision is small or the current reading is strongly biased so the revision is overlooked. So it would have filled short then reversed to a few ticks in the red and hovered.