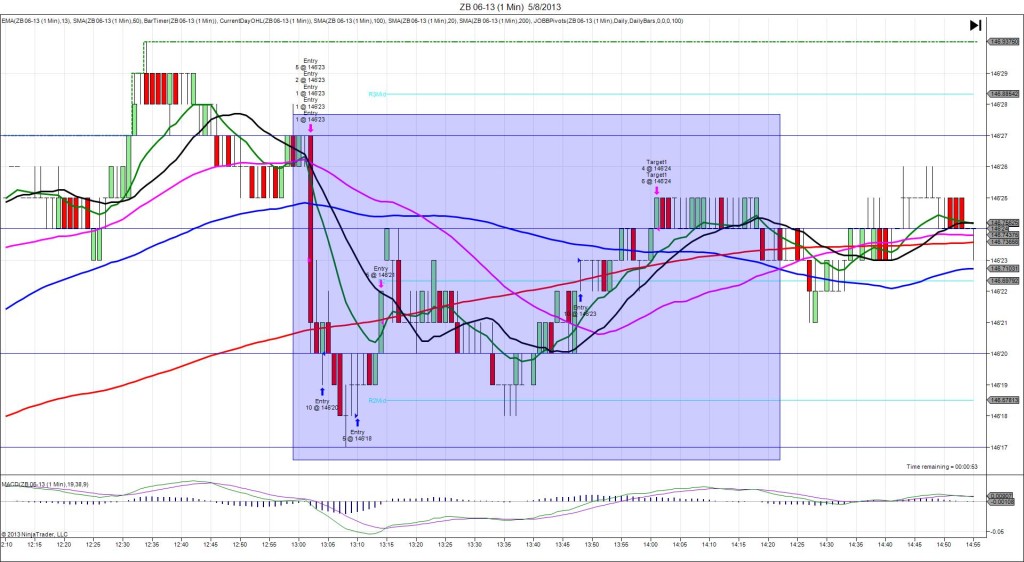

6/13/2013 30-yr Bond Auction (1301 EDT)

Previous: 2.98/2.5

Actual: 3.36/2.5

INDECISIVE

Started @ 139’24 (1301)

1st Peak @ 139’30 – 1302 (1 min)

6 ticks

Reversal to 139’11 – 1302 (1 min)

-19 ticks

Notes: Report is scheduled on Forex Factory at the bottom of the hour, but the spike always breaks 1 min late. The highest yield rose substantially compared to last month. This caused an unfortunate and shocking indecisive reaction for the second time in three months on one of our safest reports. It spiked long for 6 ticks, then immediately reversed for 19 ticks, and continued lower until the :05 bar. With JOBB you would have filled long at 139’28 with 1 tick of slippage, then stopped with 4 ticks of slippage for an 9 tick loss. The spike eclipsed the R2 Mid Pivot and the HOD, then reversed to cross all major SMAs and the R1 Pivot. Then the extended reversal crossed the R1 Mid Pivot and nearly reached the OOD before it popped back up to correct long in the next 20 min.