6/19/2013 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 0.5M

Actual: 0.3M

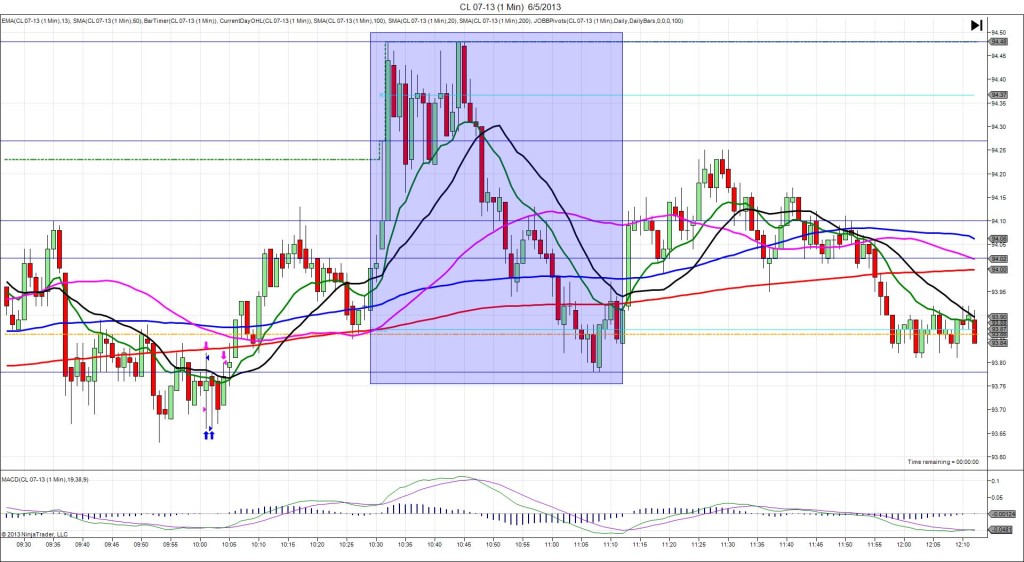

SPIKE WITH 2ND PEAK

Started @ 98.76

1st Peak @ 98.37 – 1032 (2 min)

39 ticks

Reversal to 98.71 – 1036 (6 min)

34 ticks

2nd Peak @ 98.26 – 1105 (35 min)

50 ticks

Reversal to 98.65 – 1146 (76 min)

39 ticks

Notes: Nearly matching small gain on the crude inventories, while gasoline saw a small gain. Commercial oil inventories remain just off of record highs, so the overall high supply likely brought in the bears. We saw a short spike of 39 ticks in 2 min that eclipsed the PP Pivot by 12 ticks, followed by a quick reversal that retreated to the 100/50 SMAs. With JOBB and a 10 tick buffer, you would have filled short at 98.65 with 1 tick of slippage, then seen it chop between +/- 5 ticks. I decided to set the target for 98.58 and it filled easily on the :32 bar after it was able to overcome the support in the 98.60 area. After the reversal, it fell for a 2nd peak of 11 more ticks, eclipsing the S1 Mid Pivot in the next 30 min. Then it reversed for 39 ticks in about 40 min, reaching the 200 SMA.