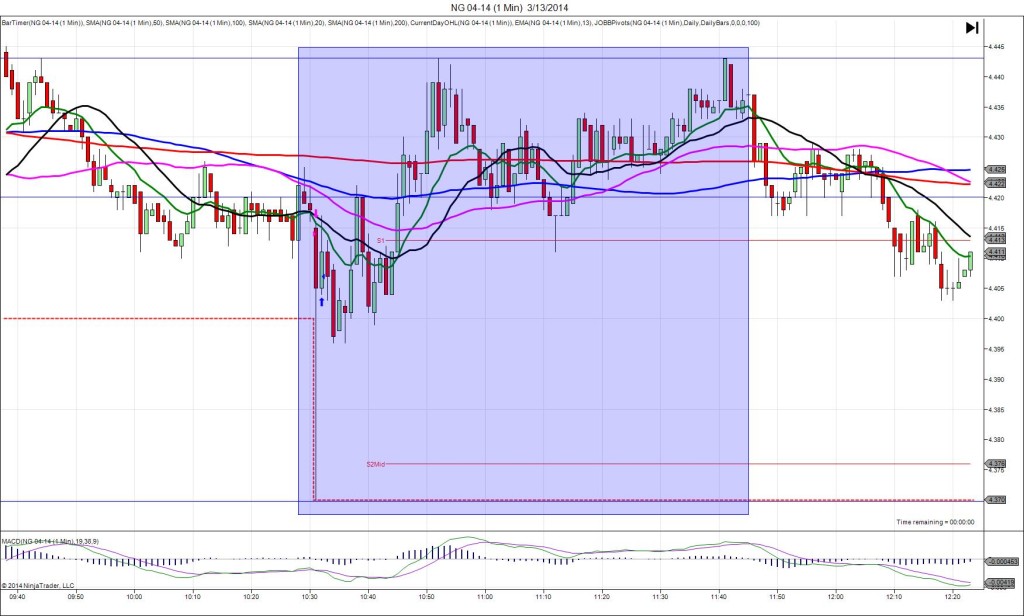

3/6/2014 Weekly Natural Gas Storage Report (1030 EST)

Forecast: -134B

Actual: -152B

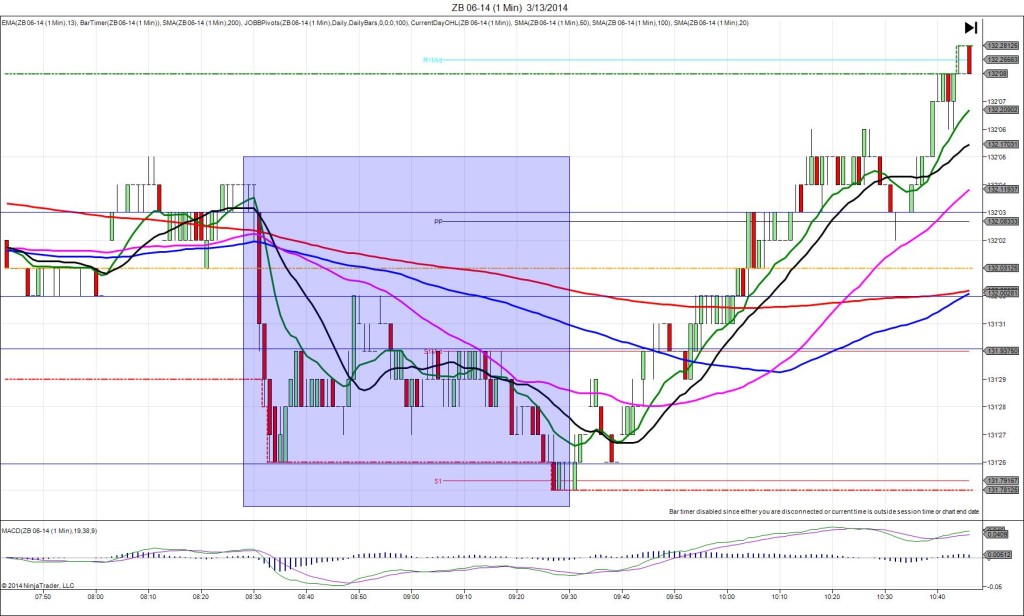

SPIKE WITH 2ND PEAK

Started @ 4.538 (1029)

1st Peak @ 4.665 – 1033 (3 min)

127 ticks

Reversal to 4.620 – 1041 (11 min)

45 ticks

2nd Peak @ 4.695 – 1056 (26 min)

157 ticks

Reversal to 4.629 – 1115 (45 min)

66 ticks

Notes: Larger draw on the reserve compared to the forecast saw a large long move with the action on the :30 bar easily contained within the bracket. The spike crossed all 3 major SMAs near the origin, the HOD, and the R1 Mid Pivot to peak on the :33 bar. With JOBB, you would have filled long at 4.575 with 27 ticks of slippage on the :31 bar, then seen it continue to ratchet upward and hover around the R1 Mid Pivot at 4.641 allowing for an easy exit with 60+ ticks. With the larger offset, this is also a safer report to be patient for a higher exit. After reaching 4.665 on the :33 bar, it reversed for 45 ticks in 10 min back to the 13 SMA. After 7 min of chopping above the 13 SMA, it climbed for a 2nd peak of 30 more ticks to the R1 Pivot in the next 10 min. Then it reversed for 66 ticks in the next 20 min to the 50 SMA and R1 Mid Pivot. After that it oscillated sideways near the R1 Mid Pivot.