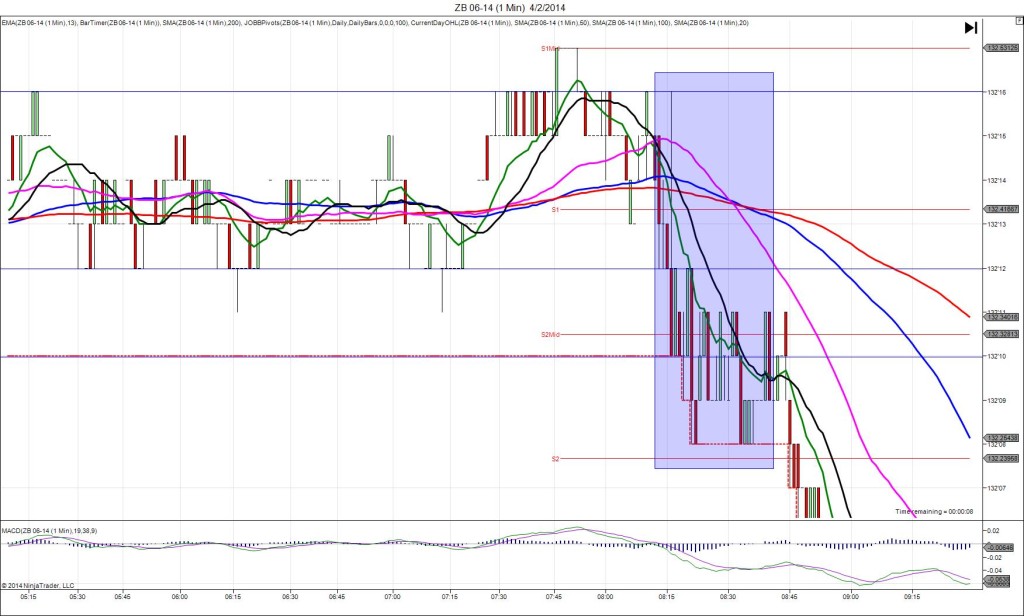

4/1/2014 Monthly ISM Manufacturing PMI (1000 EDT)

Forecast: 54.2

Actual: 53.7

Previous revision: n/a

DULL REACTION (Fill)

Started @ 132’23

1st Peak @ 132’27 – 1000:03 (1 min)

4 ticks

Reversal to 132’15 – 1008 (8 min)

12 ticks

Notes: Report came in modestly worse than the forecast, with a reading 0.5 points below the forecast causing a small and shortly sustained bullish reaction followed by a quick reversal. We saw a long spike of 4 ticks on the :01 bar that started just below the S1 Pivot / 100 SMA then crossed the 200 SMA and reached the S1 Mid Pivot for 4 ticks after 3 sec. With JOBB, you would have filled long at 132’26 with no slippage, then seen it hover on your fill point for 15 sec. Due to the narrow offset and crossing the 200 SMA acting as strong resistance, it reversed quickly back to the origin late in the bar and for 12 ticks in the next 7 min to the S2 Mid Pivot. After noticing the market hover, and knowing the situation, look to exit by moving the profit target to +1 and stop loss to -2. Then the stop would have filled at about 21 sec. After the reversal, it pulled back for 7 ticks to the 100 SMA in 14 min, then fell for a double bottom 40 min later.