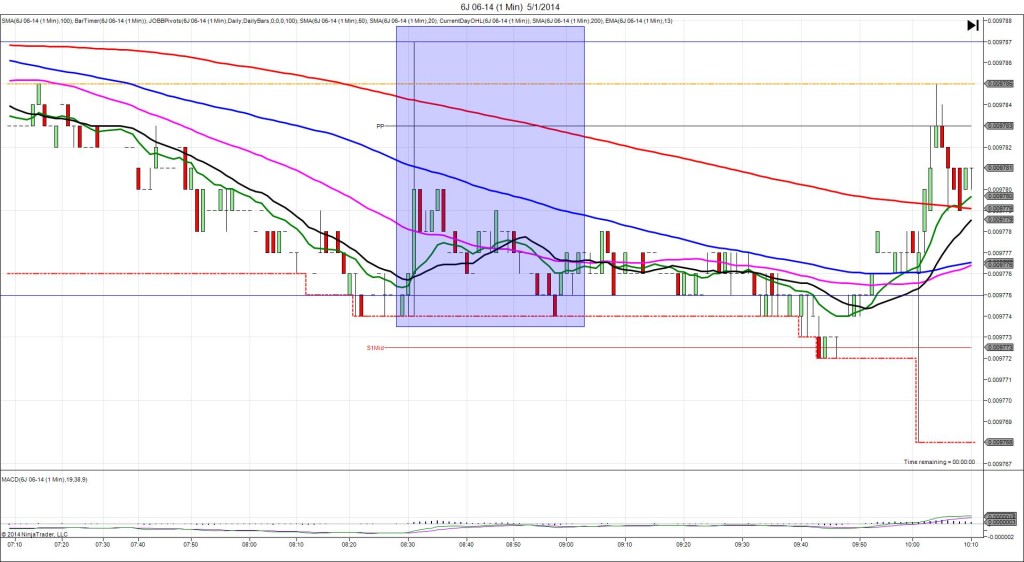

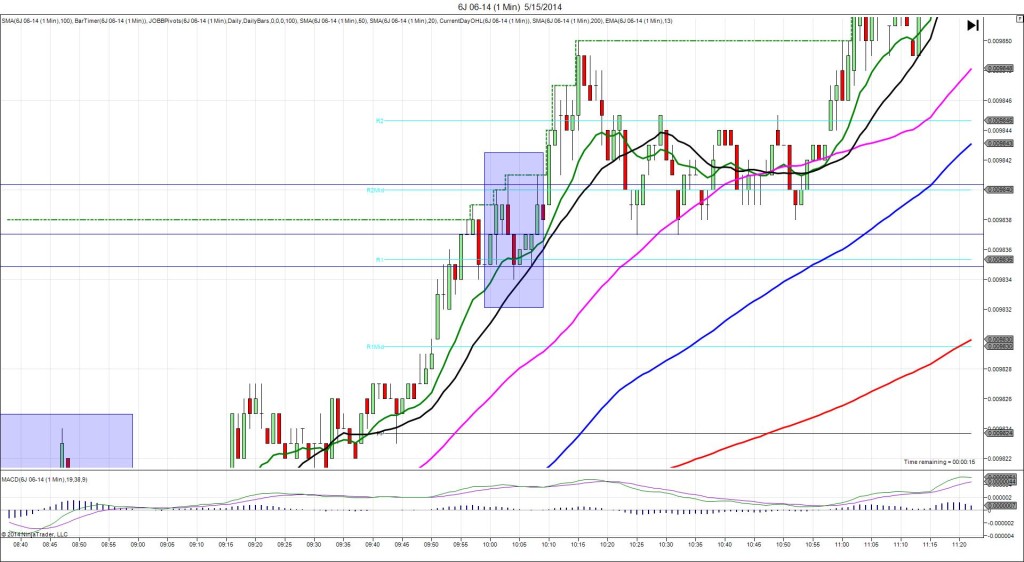

5/1/2014 Weekly Unemployment Claims (0830 EDT)

Forecast: 317K

Actual: 344K

TRAP TRADE

Anchor Point @ 0.009775 (last price)

————

Trap Trade:

)))1st Peak @ 0.009787 – 0830:02 (1 min)

)))12 ticks

)))Reversal to 0.009778 – 0830:23 (1 min)

)))9 ticks

————

Extended Reversal to 0.009774 – 0858 (28 Min)

13 ticks

Trap Trade Bracket setup:

Long entries – 0.009766 (no SMA / Pivot near) / 0.009756 (no SMA / Pivot near)

Short entries – 0.009785 (just above the PP Pivot/200 SMA) / 0.009795 (just above the HOD)

Notes: Report came in weak with 27K more jobs lost than the forecast with no other significant news. This caused a 12 tick long spike in 1 sec that rose to cross the PP Pivot, 200 SMA, and OOD then quickly backed off for 9 ticks in 21 sec. This would have filled your inner short entry tier, then allowed an exit with about 5-6 ticks quickly on the 100 SMA, or about 8 ticks later. Perfect setup for this trade and easy exit. After the reversal, it traded sideways between the LOD and 100 SMA.