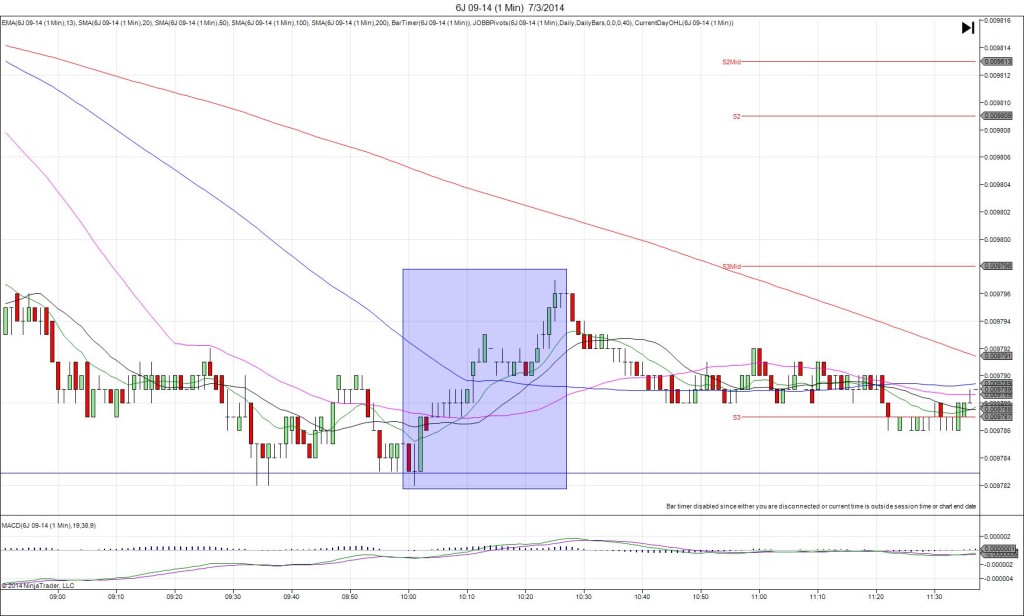

7/3/2014 Monthly ISM Non-Manufacturing PMI (1000 EDT)

Forecast: 56.2

Actual: 56.0

Previous Revision: n/a

DULL REACTION (NO FILL)

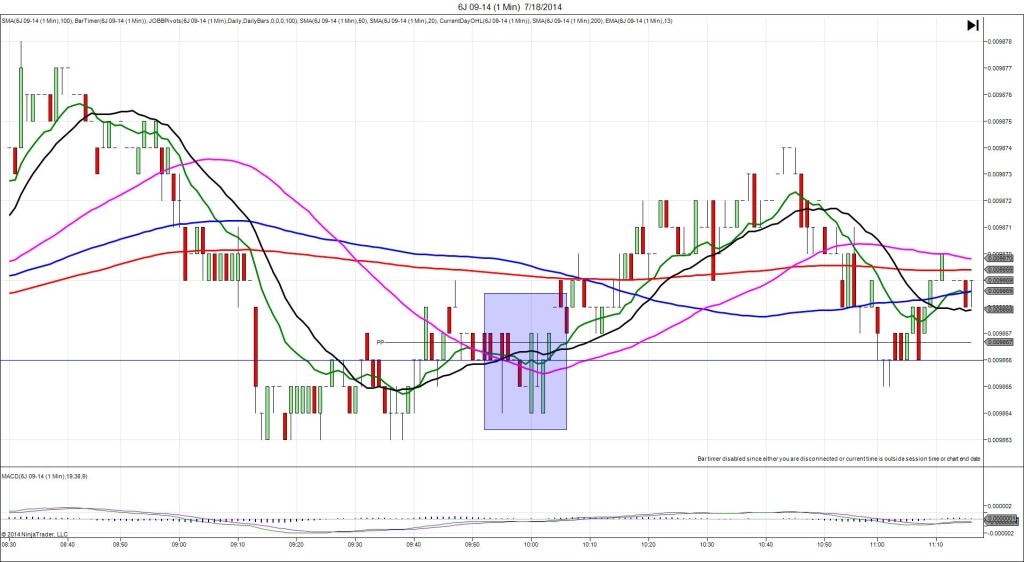

Started @ 0.009783

1st Bar Span 0.009785 – 0.009782 – 1001 (1 min)

+2/ -1 ticks

Reversal to 0.009802 – 10007 (7 min)

9 ticks

Notes: Nearly matching report fell short of the forecast by only 0.2 points. This caused a dull yawner of only 2 ticks movement from the origin. Since this was matching and would not have filled your order, cancel after 10 sec or less. The late long move was most likely a correction to the larger short move from the NFP report 90 min earlier.