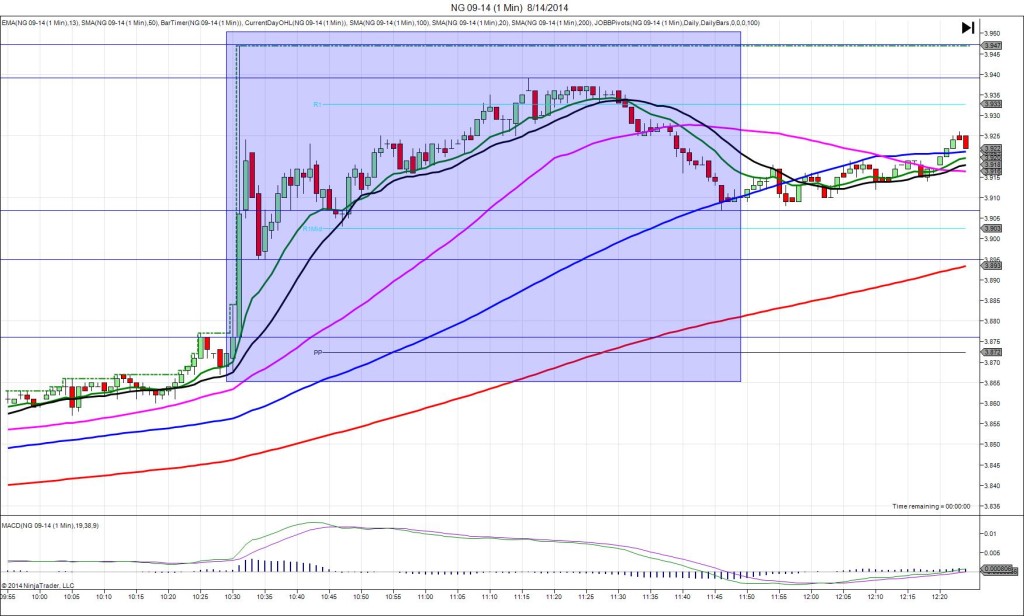

8/14/2014 Weekly Natural Gas Storage Report (1030 EDT)

Forecast: 81B

Actual: 78B

SPIKE / REVERSE

Started @ 3.876

1st Peak @ 3.947 – 1030:00 (1 min)

71 ticks

Reversal to 3.895 – 1034 (4 min)

52 ticks

Pullback to 3.939 – 1116 (46 min)

44 ticks

Reversal to 3.907 – 1146 (76 min)

32 ticks

Notes: We saw a smaller gain on the reserve compared to the forecast by 3BCF which caused a long spike that started just above the PP Pivot and rose to cross the R1 Pivot and extend the HOD for 71 ticks in the first second. With JOBB, you would have filled long at about 3.919 with about 33 ticks of slippage, then seen it oscillate around the R1 Pivot for the first 30 sec of the :31 bar. A profit target of 25 ticks or less would have easily filled. Otherwise, look to exit around 3.940 with about 20 ticks. It reversed for a total of 52 ticks in the next 3 bars as it crossed the R1 Mid Pivot and nearly reached the 13 SMA. Then it slowly pulled back for 44 ticks in the next 42 min, using the 13/20 SMAs for support until it crossed the R1 Pivot. Then it reversed 32 ticks in the next 30 min to the 100 SMA.