9/2/2014 Monthly ISM Manufacturing PMI (1000 EDT)

Forecast: 57.0

Actual: 59.0

Previous revision: n/a

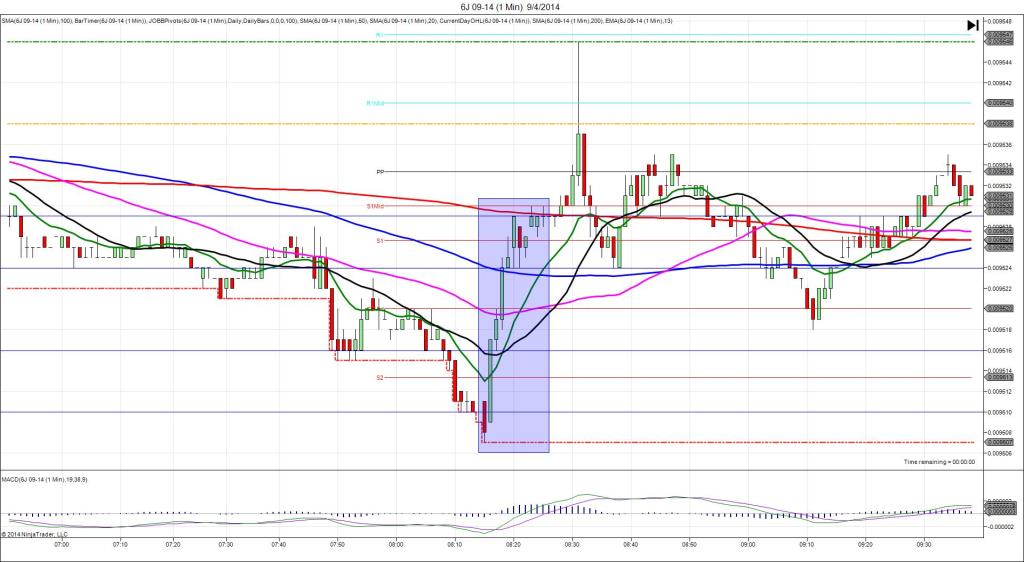

SPIKE WITH 2ND PEAK

Started @ 0.009527

1st Peak @ 0.009516 – 1000:00 (1 min)

11 ticks

Reversal to 0.009527 – 1005 (5 min)

11 ticks

2nd Peak @ 0.009505 – 1026 (26 min)

22 ticks

Reversal to 0.009519 – 1056 (56 min)

14 ticks

Pullback to 0.009510 – 1054 (54 min)

9 ticks

Notes: Report came in strongly above the forecast with a deviation of 2.0 pts and came the closest to the psychological level of 60 in years. This caused a quick short spike of 11 ticks that started on the 20 SMA and fell to extend the LOD. It retraced for several ticks in the early part of the bar, then fell to settle around 0.009519. Since this was the day after a US holiday, the Pivots were distorted and out of the picture. With JOBB, you would have filled short at 009521 with 2 ticks of slippage, then look to exit where it hovered late in the :01 bar for about 2 ticks. After the peak, it reversed back to the origin in 4 min producing a perfect opportunity for a short entry for a 2nd peak trade. A short entry at 0.009526 on the 20 SMA would have been ideal for 15+ ticks. It fell for 22 ticks in 21 min, extending the LOD and using the 13 SMA as resistance. An exit around 0.009512 would have been safe after several minutes of trading sideways. Then it reversed 14 ticks in the next 30 min, crossing the 50 SMA. After that it pulled back 9 ticks and traded sideways on the 50 SMA.