9/11/2014 World Agriculture Supply and Demand Estimates (WASDE) – Soybeans (1200 EDT)

Forecast: n/a

Actual: n/a

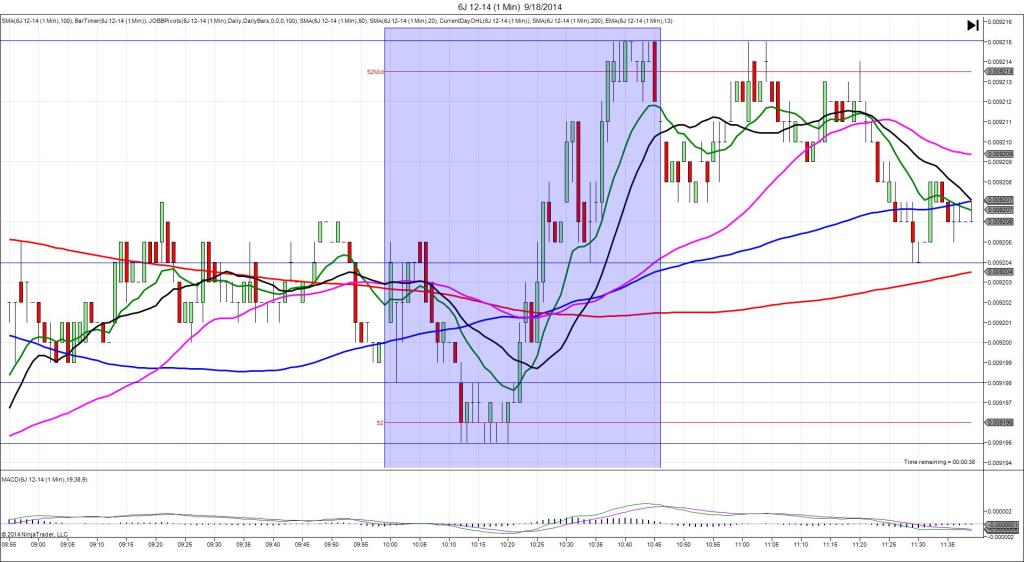

SPIKE WITH 2ND PEAK

Started @ 975.50 (1200:32)

1st Peak @ 972.00 – 1200:59 (1 min)

14 ticks

Reversal to 982.00 – 1202:48 (3 min)

40 ticks

Pullback to 969.50 – 1223 (23 min)

50 ticks

Reversal to 977.25 – 1246 (46 min)

31 ticks

Notes: With the beans, we recommend a delayed setup at 32 sec. In this case the initial reaction would have been safe to trade for the second month in a row, but that is often not the case. it would have been tame as it hovered near the S3 Pivot to provide an anchor point at 975.50 at 32 sec. With JOBB, your short entry would have filled at 974.00 with no slippage, then fallen a little more to the S4 Mid Pivot to allow about 6-8 ticks to be captured when it hovered at the bottom of the bar. Since the fill was short and continuing in the initial direction of the spike, look for a smaller target and exit quickly at the first sign of hovering. After that the reversal rebounded for 40 ticks in a little less than 2 min to the S3 Mid Pivot, then pulled back for a 2nd peak of 10 more ticks 20 min later. Then it reversed for 31 ticks back to the S3 Pivot and 50 SMA 23 min later.