3/16/2016 Weekly Crude Oil Inventory Report (1030 EDT)

Forecast: 3.41M

Actual: 1.32M

Gasoline

Forecast: -2.34M

Actual: -0.75M

Distillates

Forecast: -1.08M

Actual: -1.14M

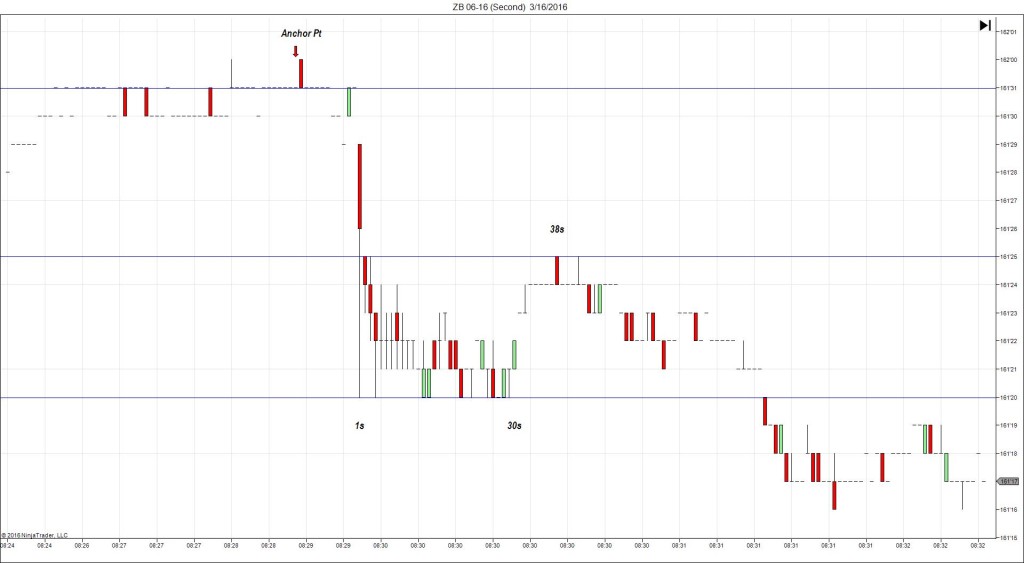

DULL FILL

Started @ 39.04

1st Peak @ 39.33 – 1030:00 (1 min)

29 ticks

Reversal to 38.99 – 1030:22 (1 min)

34 ticks

Pullback to 39.32 – 1030:36 (1 min)

33 ticks

Reversal to 38.82 – 1034 (4 min)

50 ticks

Pullback to 39.31 – 1045 (15 min)

49 ticks

Expected Fill: 39.19 (long)

Slippage: 5 ticks

Best Initial Exit: 39.19 – Breakeven

Recommended Profit Target placement: 39.36 (just above the HOD)

Notes: Unsustainable long spike reached the HOD then promptly recoiled. It hovered at the fill point for 4 sec before dropping and hovering 9 ticks lower. Either place would have presented an opportunity to exit near the entry or for a smaller loss than a full stop out. Otherwise the stop would have been taken after about 13 sec. After that it oscillated between the HOD and 50 SMA with one excursion to the 100 SMA.