11/5/2014 Weekly Crude Oil Inventory Report (1030 EST)

Forecast: 1.90M

Actual: 0.46M

Gasoline

Forecast: -1.00M

Actual: -1.38M

Distillates

Forecast: -1.95M

Actual: -0.72M

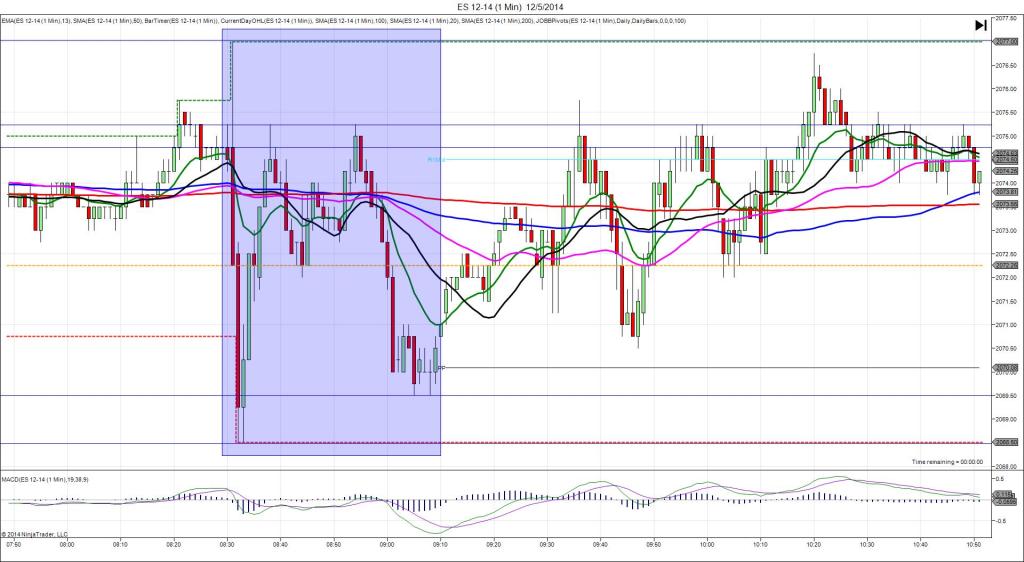

INDECISIVE

Started @ 78.05

1st Peak @ 78.21 – 1030:00 (1 min)

16 ticks

Reversal to 77.75 – 1031:04 (2 min)

46 ticks

Final Peak @ 79.35 – 1054 (24 min)

130 ticks

Reversal to 77.63 – 1126 (56 min)

172 ticks

Notes: Modest gain in inventories when a moderate gain was expected, while gasoline saw a slightly larger moderate draw than what was expected, and distillates saw a modest draw when a moderate draw was expected. This caused a whipsaw initially as the price climbed 16 ticks in the first second then fell 14 ticks immediately. With JOBB and a 10 tick buffer, you would have filled long at about 78.17 with 2 ticks of slippage, then you would have been stopped out to the tick for 15 ticks loss on the next second at 78.02. It continued to chop around without conviction as it reversed 46 ticks in the next minute to the R1 Pivot, then climbed for a 2nd peak of 114 more ticks in the next 22 min as it reached the R3 Mid Pivot. Then it reversed for 172 ticks in the next 32 min as it crossed the 200 SMA and R1 Pivot. The small deviations from the forecasts to the actual results caused initial instability followed by large swings.