10/22/2014 Core CPI (0830 EDT)

Core Forecast: 0.2%

Core Actual: 0.1%

Previous revision: n/a

Regular Forecast: 0.0%

Regular Actual: 0.1%

Previous Revision: n/a

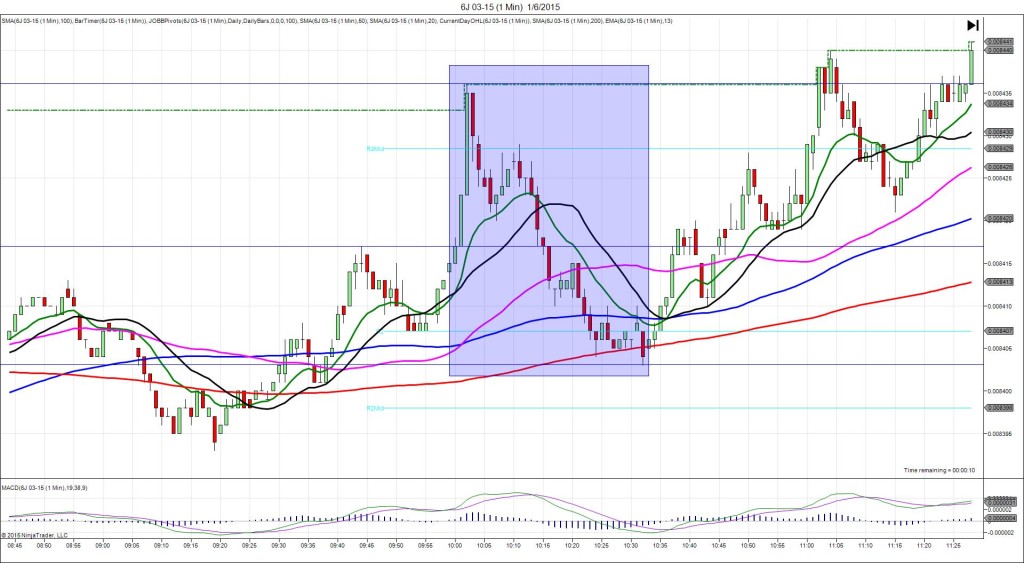

SPIKE WITH 2ND PEAK

Started @ 0.009350

1st Peak @ 0.009333 – 0831:09 (2 min)

17 ticks

Reversal to 0.009345 – 0837 (7 min)

12 ticks

2nd Peak @ 0.009320 – 0902 (32 min)

26 ticks

Reversal to 0.009337 – 0944 (74 min)

17 ticks

Notes: The core reading fell short of the forecast by 0.1% while the broader reading exceeded the forecast by 0.1%. This caused a 17 tick short spike that started on the 20 SMA and fell to nearly reach the S3 Mid Pivot and extend the LOD. With JOBB and a 4 tick bracket, your short order would have filled at 0.009343 with 3 ticks of slippage. You would have seen it hover at 0.009336 for a long time in the middle of the :31 bar, so look to exit there with about 7 ticks. After testing the S3 Mid Pivot a few more times, it reversed for 12 ticks in 5 min to the 20 SMA and S2 Pivot. Then it fell for a 2nd peak of 9 more ticks in 25 min to nearly reach the S3 Pivot before reversing 17 ticks in 42 min to the 100 SMA.