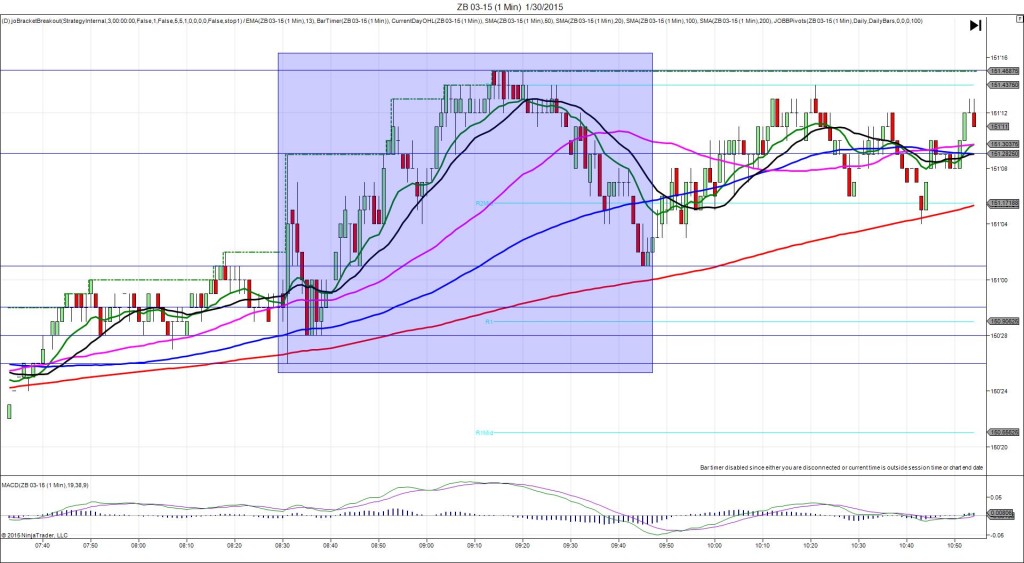

1/30/2015 Quarterly Advance GDP (0830 EST)

Forecast: 3.0%

Actual: 2.6%

Previous Revision: +1.5% to 5.0%

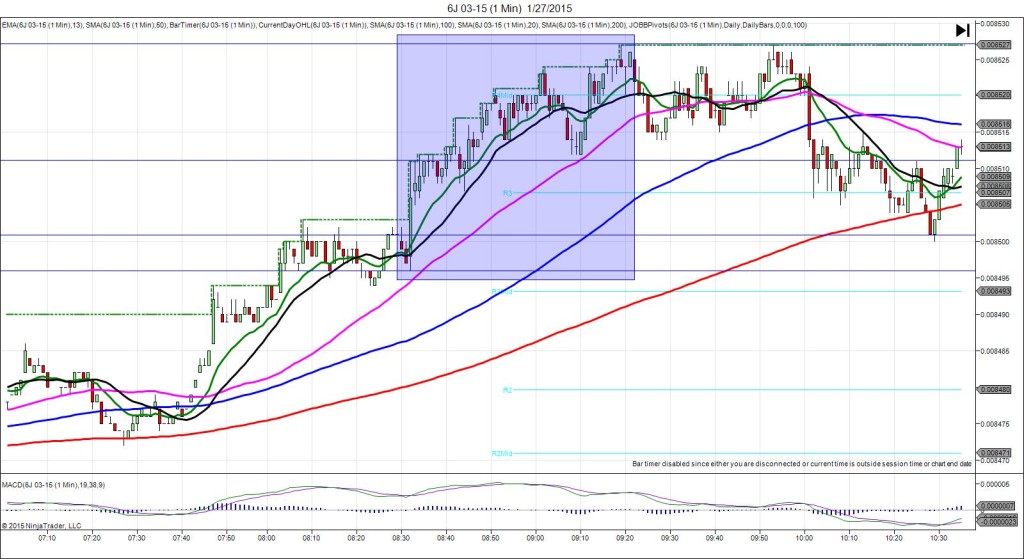

TRAP TRADE – INNER TIER

Anchor Point @ 150’30 (last price)

————

Trap Trade:

)))1st Peak @ 151’04 – 0830:01 (1 min)

)))6 ticks

)))Reversal to 150’26 – 0830:06 (1 min)

)))-10 ticks

)))Pullback to 151’09 – 0830:45 (1 min)

)))15 ticks

)))Reversal to 151’01 – 0831:24 (2 min)

)))-8 ticks

————

Continued Reversal to 150’28 – 0835 (5 min)

13 ticks

2nd Peak @ 151’15 – 0914 (44 min)

17 ticks

Reversal to 151’01 – 0945 (75 min)

15 ticks

Trap Trade Bracket setup:

Long entry – 150’20 (just below the R1 Mid Pivot)

Short entry – 151’08 (just above the R2 Mid Pivot)

Notes: Report came in moderately weak falling short of the forecast by 0.4%. This caused small swings up and down until about 20 sec into the bar when it approached the short entry at 151’08. It would have filled right about the time you would have considered cancelling, then it backed off nicely to allow 5-6 ticks to be captured on the first instance of hovering, and would have allowed another 5-6 ticks near the 100 SMA after 5 min. After that it climbed for a 2nd peak of 6 more ticks in 39 min to the R2 Pivot. Then it reversed 15 ticks to nearly reach the 200 SMA in 31 min.