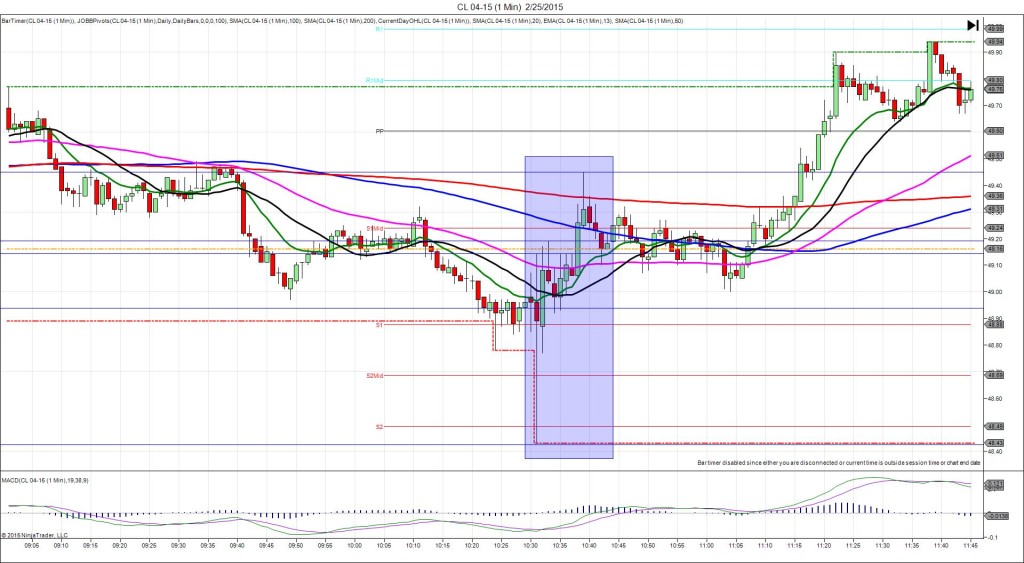

3/13/2015 Prelim UoM Consumer Sentiment (1000 EST)

Forecast: 95.6

Actual: 91.2

Previous Revision: +1.8 to 95.4

TRAP TRADE – INNER TIER

Anchor Point @ 0.008231 (last price)

————

Trap Trade:

)))1st Peak @ 0.008238 – 1000:00 (1 min)

)))7 ticks

)))Reversal to 0.008227 – 1001:46 (2 min)

)))-11 ticks

————

2nd Peak @ 0.008239 – 1009 (9 min)

8 ticks

Reversal to 0.008233 – 1014 (14 min)

6 ticks

Trap Trade Bracket setup:

Long entries – 0.008225 (just below the LOD) / 0.008216 (No SMA / Pivot near)

Short entries – 0.008237 (in between the 100 SMA / S1 Mid Pivot) / 0.008246 (just below the HOD)

Notes: The report came in lower than the forecast by 4.4 points but was offset by a moderate upward previous revision causing a 7 tick long move immediately. This would have filled your inner short entry with 1 tick to spare, then fallen gradually for 11 ticks in the next 1.5 min. Look to exit just below the 20 SMA with about 8 ticks. After that it climbed for a 2nd peak that achieved 1 more tick in 7 min before reversing 6 ticks in 5 min to the 50 SMA.