2/13/2015 Prelim UoM Consumer Sentiment (1000 EST)*Late time change

Forecast: 98.2

Actual: 93.6

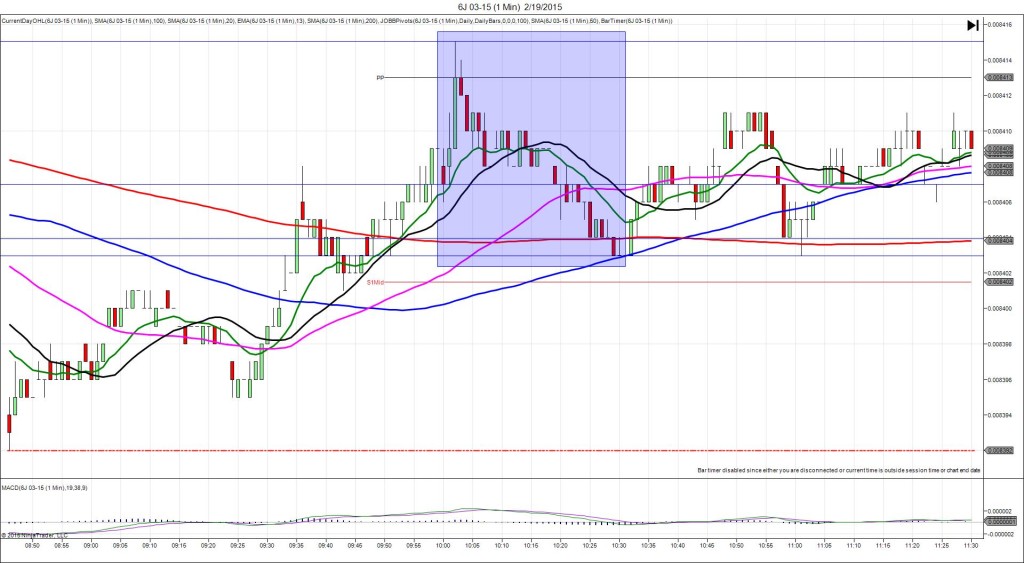

TRAP TRADE – INNER TIER

Anchor Point @ 0.0008404 (last price)

————

Trap Trade:

)))1st Peak @ 0.008415 – 1000:02 (1 min)

)))11 ticks

)))Reversal to 0.008408 – 1001:01 (2 min)

)))-7 ticks

————

2nd Peak @ 0.008435 – 1005 (5 min)

31 ticks

Reversal to 0.008419 – 1034 (34 min)

16 ticks

Trap Trade Bracket setup:

Long entries – 0.008398 (just above the OOD) / 0.008390 (just below the LOD)

Short entries – 0.008410 (just above the 50 SMA) / 0.008419 (No SMA / Pivot near)

Notes: The report came in lower than the forecast by 4.6 points causing an 11 tick long move in 2 sec. This would have filled your inner short entry and missed the outer tier by 4 ticks then fallen 7 ticks in the next min to allow an exit with 1-2 ticks at 0.008408 where it hovered for over 30 sec. Then it rallied for a 2nd peak of 20 more ticks in 3 min as it eclipsed the R1 Mid Pivot before reversing 16 ticks in 29 min to the 50 SMA.