4/24/2015 Monthly Durable Goods Orders (0830 EDT)

Core Forecast: 0.2%

Core Actual: -0.2%

Previous revision: -0.2% to -0.6%

Regular Forecast: 0.7%

Regular Actual: 4.0%

Previous Revision: +0.3% to -1.1%

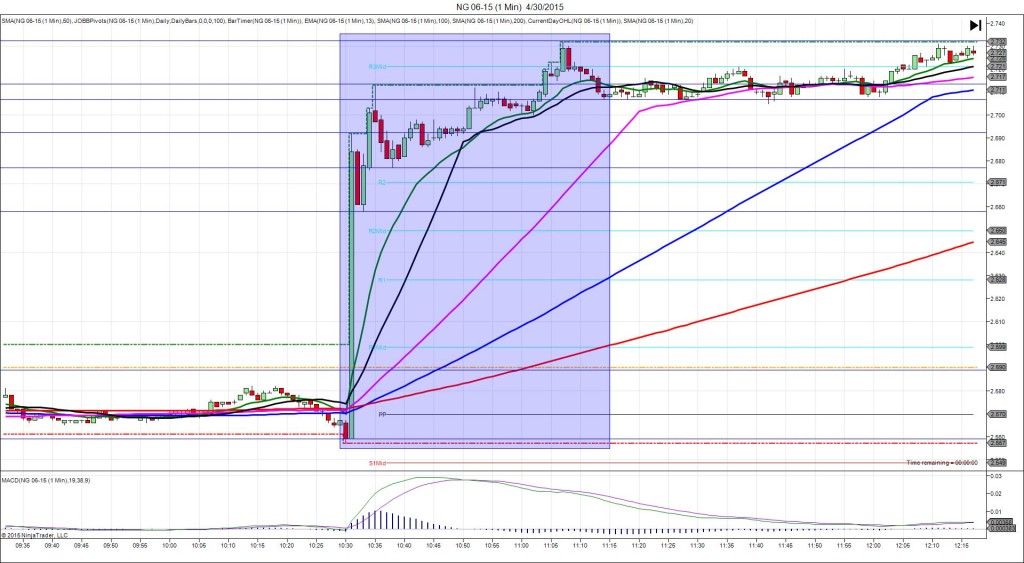

TRAP TRADE – INNER TIER

Anchor Point @ 0.008377 (shift up 3 ticks to 0.008380)

————

Trap Trade:

)))1st Peak @ 0.008369 – 0830:04 (1 min)

)))-11 ticks

)))Reversal to 0.008387 – 0830:28 (1 min)

)))18 ticks

————

Pullback to 0.008378 – 0833 (3 min)

9 ticks

Reversal to 0.008406 – 0940 (70 min)

28 ticks

Pullback to 0.008390 – 1007 (97 min)

16 ticks

Trap Trade Bracket setup:

Long entries – 0.008370 (just below the 100/200 SMAs) / 0.008360 (just below the PP Pivot / LOD)

Short entries – 0.008391 (just above the R1 Pivot) / 0.008400 (just above the R2 Mid Pivot)

Notes: Conflicting report caused an typical whipsaw that fell 11 ticks in 4 sec to cross the 100/200 SMAs then reverse. Your initial anchor point would have setup at 0.008377, but should be shifted up about 3 ticks due to the drift of the market. This would have filled you inner long entry with 1 tick to spare then reversed after a few sec for a total of 18 ticks in 25 sec where it hovered for about 30 sec to allow an easy exit with about 16 ticks. After that it pulled back 9 ticks in 2 min to the 13 SMA before reversing 28 ticks in 67 min to the R2 Pivot. Then it pulled back 16 ticks in 27 min to the R1 Pivot.