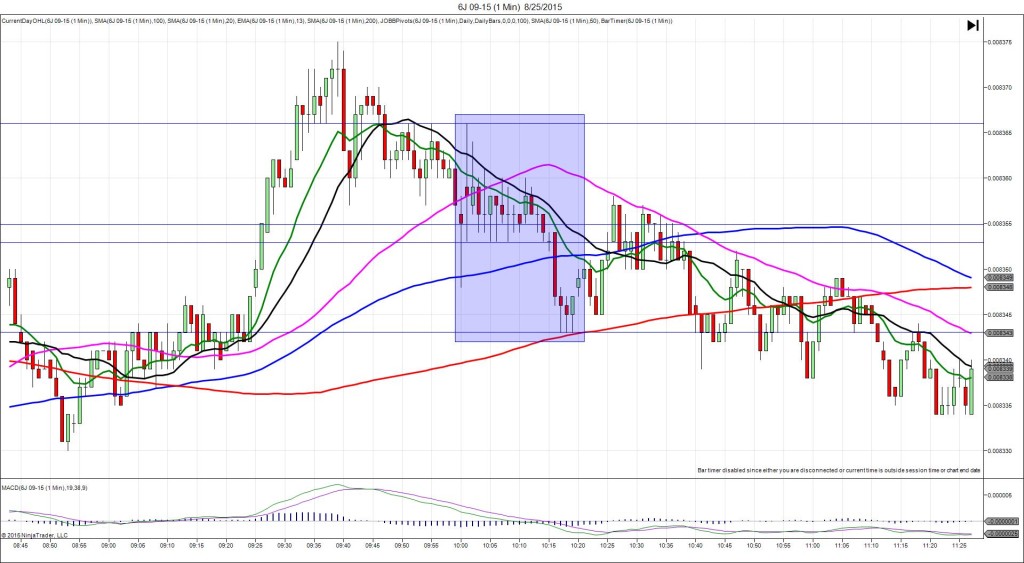

Caption for 8/19:

8/19/2015 Core CPI (0830 EDT)

Core Forecast: 0.2%

Core Actual: 0.1%

Previous revision: n/a

Regular Forecast: 0.2%

Regular Actual: 0.1%

Previous Revision: n/a

INDECISIVE

Started @ 0.008047

1st Peak @ 0.008085 – 0830:01 (1 min)

38 ticks

Reversal to 0.008053 – 0830:02 (1 min)

32 ticks

Continued Reversal to 0.008038 – 0838 (8 min)

47 ticks

Notes: The core reading fell short of the forecast and the broader reading also missed the forecast. This caused a bizarre large unsustainable spike of 38 ticks to the R4 Mid Pivot that immediately collapsed. 26 tick large short spike that started on the 200 SMA and fell to immediately cross the OOD, then trickle lower another 13 ticks in 30 sec. With JOBB and a 4 tick bracket, your short order would have filled at 0.008267 with 3 ticks of slippage. Then you would have seen it fall and hover initially at 0.008249 to allow 18 ticks to be captured. After a minimal reversal, and with no support barrier near, it continued to fall for a final peak of 19 more ticks in 9 min. Then it reversed 8 ticks in 4 min and traded sideways.