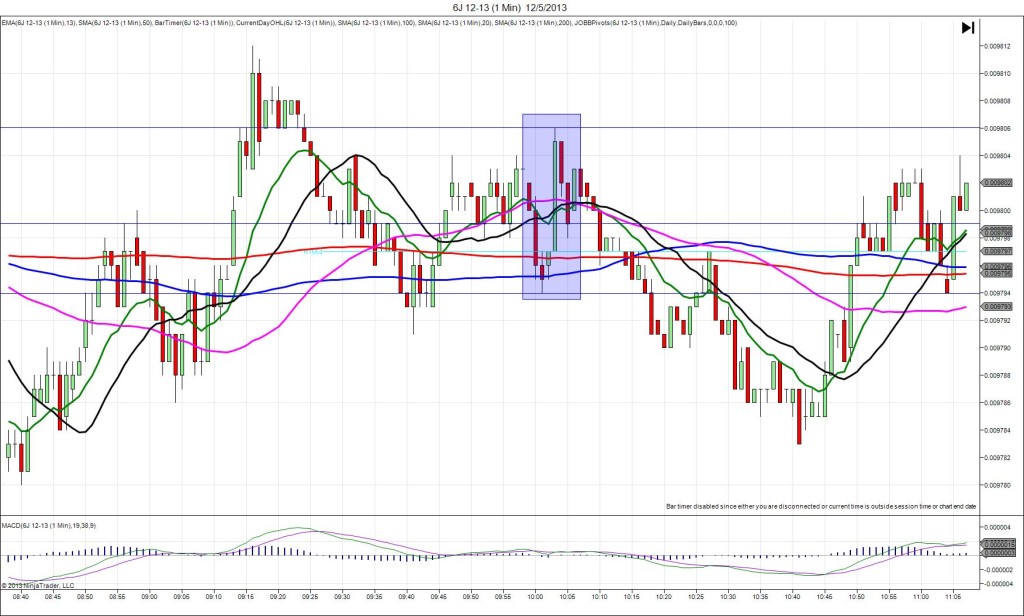

8/8/2013 Weekly Unemployment Claims (0830 EDT)

Forecast: 336K

Actual: 333K

SPIKE / REVERSE

Started @ 0.010376

1st Peak @ 0.010368 – 0831 (1 min)

8 ticks

Reversal to 0.010383 – 0831 (1 min)

15 ticks

Extended Reversal to 0.010414 – 0857 (27 min)

46 ticks

Notes: Report came in nearly matching, but slightly better than the forecast by 3k jobs, causing an initial short spike of 8 ticks that was shortly sustained. It crossed only the OOD and no other discernable support barrier. With JOBB, your short order would have filled at 0.010372 with no slippage then only shown 4 ticks of profit which would have vanished after 11 sec. This is where you need to exit quickly between breakeven and 2-3 ticks after recognition of the scenario. In any event, do not be asleep at the switch and eat a 10 tick loss unnecessarily. It would also be advisable to reverse the trade on the short move expecting a reversal. It reversed 15 ticks in the latter part of the :31 bar, and continued for an extended reversal of 46 ticks in the next 25 min, crossing the HOD and the R1 Pivot.