2/1/2016 Monthly ISM Manufacturing PMI (1000 EST)

Forecast: 48.6

Actual: 48.2

Previous revision: n/a

DULL NO FILL

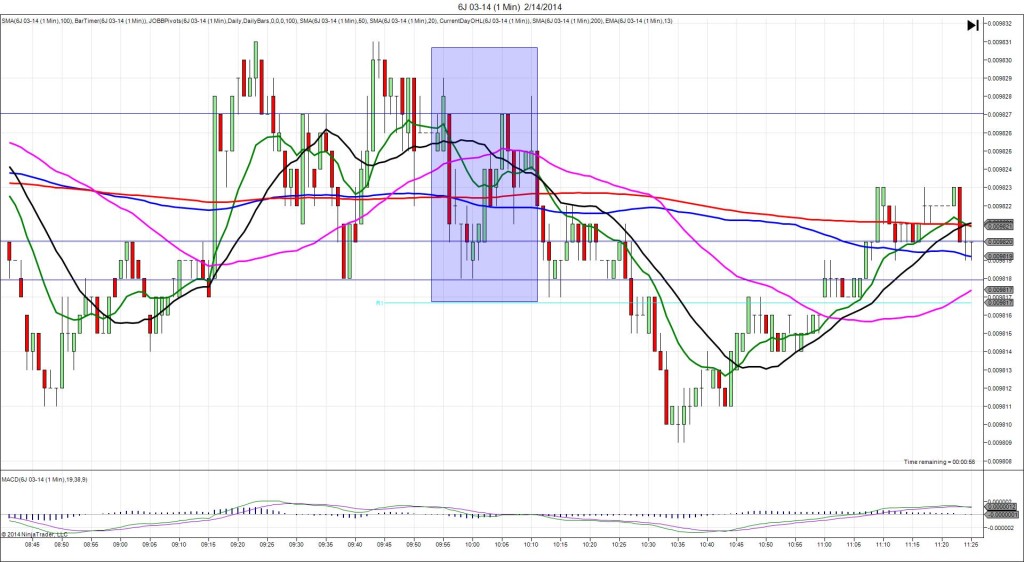

Started @ 0.008283

1st Peak @ 0.008289 – 1000:42 (1 min)

6 ticks

2nd Peak @ 0.008294 – 1003 (3 min)

11 ticks

Reversal to 0.008275 – 1014 (14 min)

19 ticks

Expected Fill: n/a – cancel

Slippage: n/a

Best Initial Exit: n/a

Recommended Profit Target placement: n/a

Notes: Only moved 2 ticks away from the origin until 22 sec after the release, so cancel the order on the dull move. It eventually gained 6 ticks then another 5 ticks on a 2nd peak after 3 min before reversing as the overall long trend found resistance after crossing the R1 Pivot with the R2 Mid Pivot looming above.