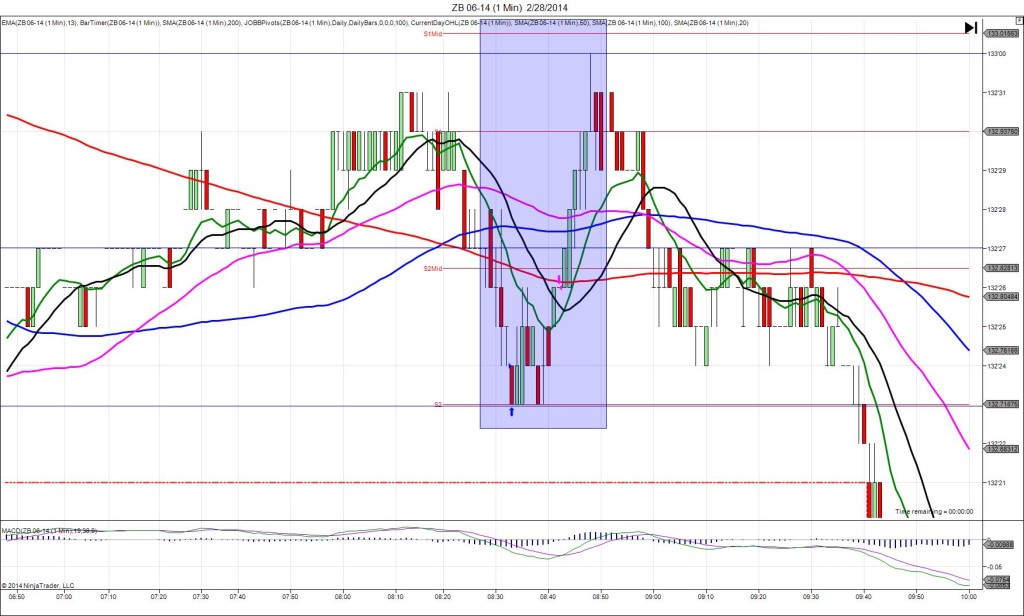

2/27/2014 Monthly Durable Goods Orders (0830 EST)

Core Forecast: -0.1%

Core Actual: 1.1%

Previous revision: +0.3% to -1.3%

Regular Forecast: -0.7%

Regular Actual: -1.0%

Previous Revision: +0.1% to -4.2%

TRAP TRADE (SPIKE WITH 2ND PEAK)

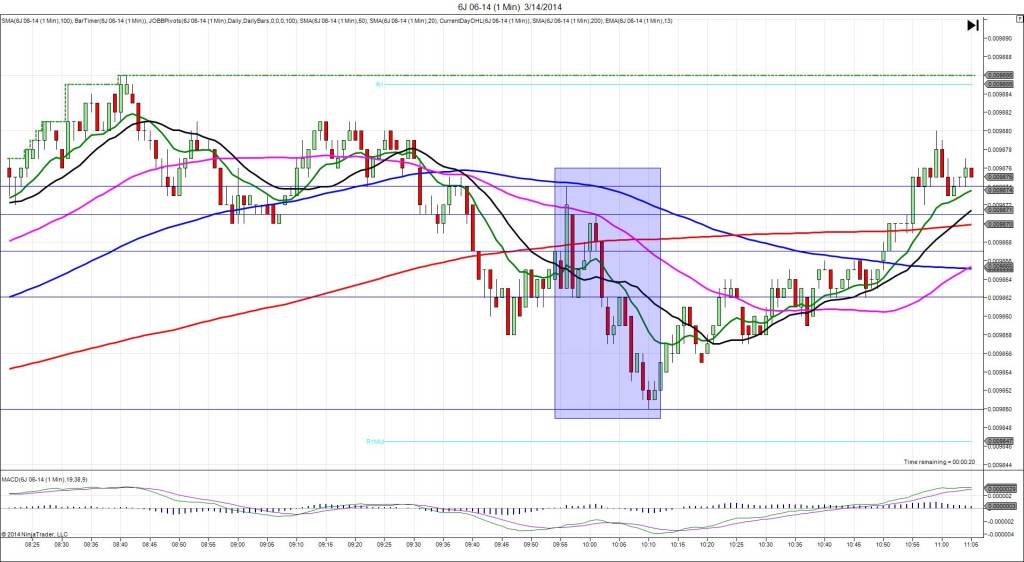

Anchor Point @ 0.009817 (last price)

————

Trap Trade:

)))1st Peak @ 0.009806 – 0830:06 (1 min)

)))-11 ticks

)))Reversal to 0.009812 – 0831:59 (2 min)

)))6 ticks

————

Final Peak @ 0.009791 – 0845 (15 min)

26 ticks

Reversal to 0.009799 – 0857 (27 min)

8 ticks

Trap Trade Bracket setup:

Long entries – 0.009806 (no SMA / Pivot near) / 0.009799 (just below the R2 Mid Pivot)

Short entries – 0.009829 (just below the HOD) / 0.009837 (just below the R3 Mid Pivot)

Notes: Report came in mixed with the core reading exceeding the forecast by 1.2%, while the regular reading fell short of the forecast by 0.3% and weekly unemployment claims came in 15k worse than expected. With the mixed news, the bullish news won the influence battle to cause an 11 ticks short move that peaked not near any barrier. With the Trap Trade, you would have filled long at 0.009806, then seen it only retreat 6 ticks as it hovered tamely between the fill point and 6 ticks of profit. Look to exit with 4-5 ticks after 2 min when it appears to be unable to go higher. It is odd that the claims and regular reading did not cause a larger reversal, but we aware of what the market is giving you. After about 4 min of hovering, it fell for a 2nd peak of 15 more ticks, crossing the R2 Mid Pivot in the next 10 min. Then it reversed for 8 ticks, crossing the 13/20 SMAs.