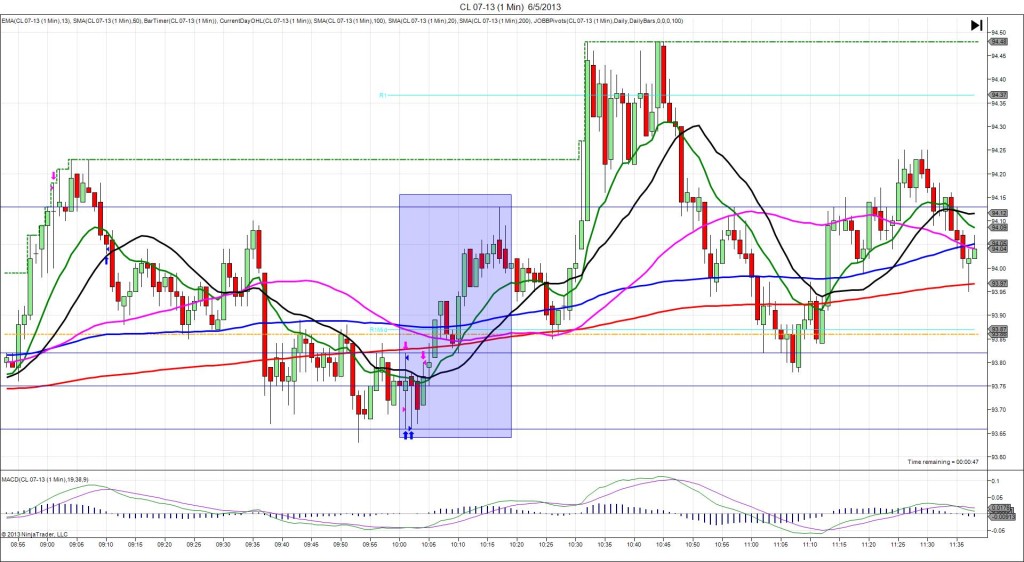

6/27/2013 Weekly Unemployment Claims (0830 EDT)

Forecast: 347K

Actual: 346K

INDECISIVE

Started @ 0.010187

1st Peak @ 0.010178 – 0831 (1 min)

9 ticks

Reversal to 0.010227 – 0831 (1 min)

-49 ticks

Notes: Report came in matching the forecast causing an indecisive reaction. Fortunately, the premature volatility was a tripwire to disable the strategy and cancel the order. It started chopping between the 20/13 SMAs and 200 SMA, then spiked short initially for 9 ticks before reversing for 49 ticks. Then it fell back to settle about 15 ticks higher. With JOBB, you would have filled short then taken a 12-14 tick loss with slippage. After the :31 bar, it slowly fell to the S2 Pivot in the next 30 min, then traded sideways.